The rise of Figure Stock from its 2022 inception to a robotics powerhouse is nothing short of remarkable. Founded by AI visionaries, the company quickly made waves by blending cutting-edge software with advanced hardware. Early adopters noted the agility of the Figure Stock Robot platform in real-world tasks.

In under three years, Figure Stock forged critical partnerships with major manufacturers. These alliances fueled its first Series A round, cementing its reputation as a robust stock in the tech sector. Investors began tracking the Figure Stock Price with enthusiasm, anticipating strong returns.

?? Early Funding & Founding Milestones

At launch, Figure Stock secured a $15M seed round backed by prominent VCs. The team emphasized modular design and open APIs. This approach set the stage for its NASDAQ debut under the ticker Figure Stock Symbol “FGR” in mid-2023.

The Figure Stock IPO was oversubscribed 3x, reflecting excitement in both AI and robotics communities. Wall Street saw parallels to how SpaceX Stock transformed aerospace investments.

?? Technological Breakthroughs

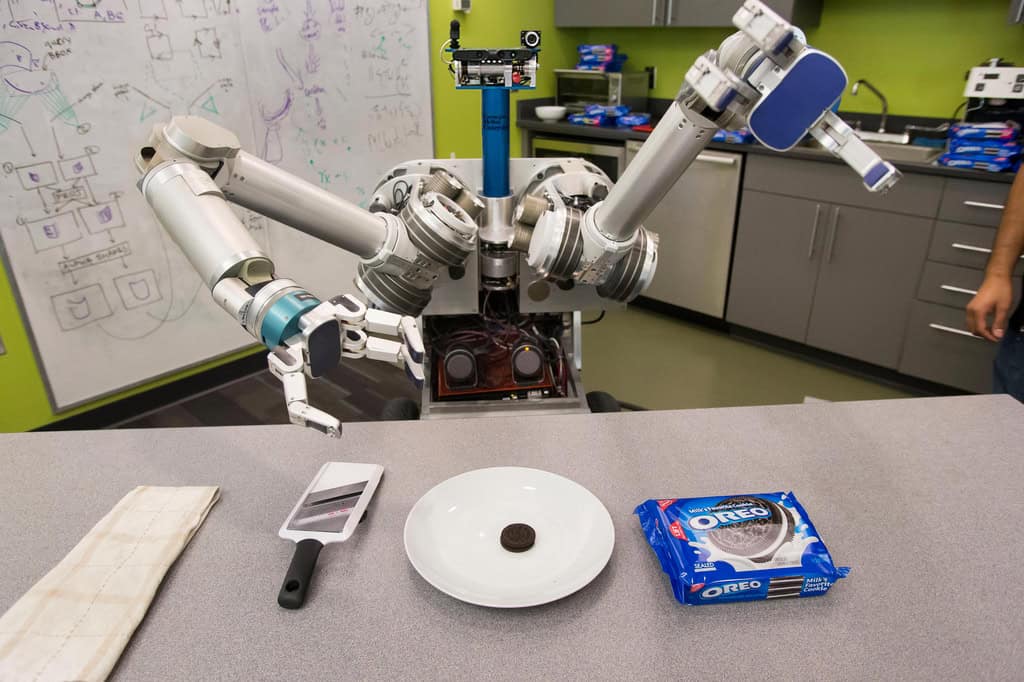

By Q1 2024, Figure Stock unveiled its flagship arm, capable of sub-millimeter precision. This advancement boosted industrial adoption in assembly lines and medical labs. Case studies showed a 40% productivity increase when paired with custom vision modules.

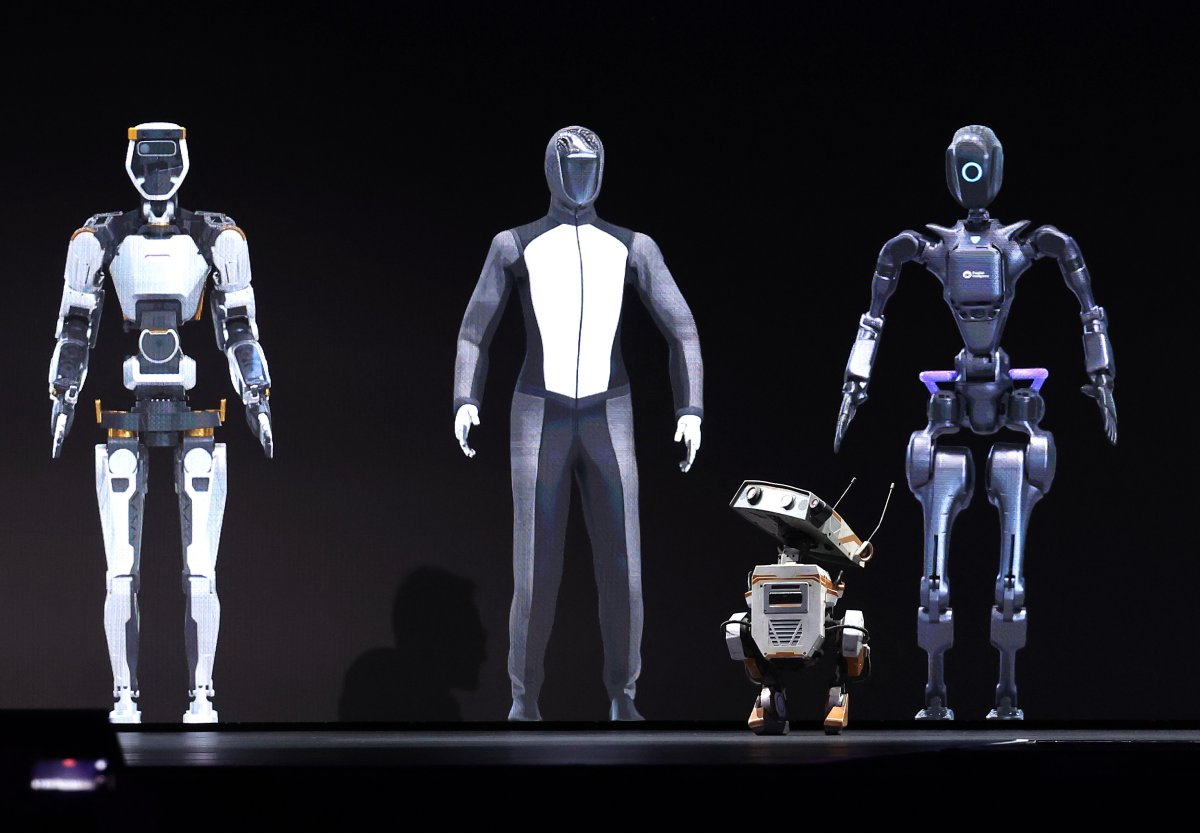

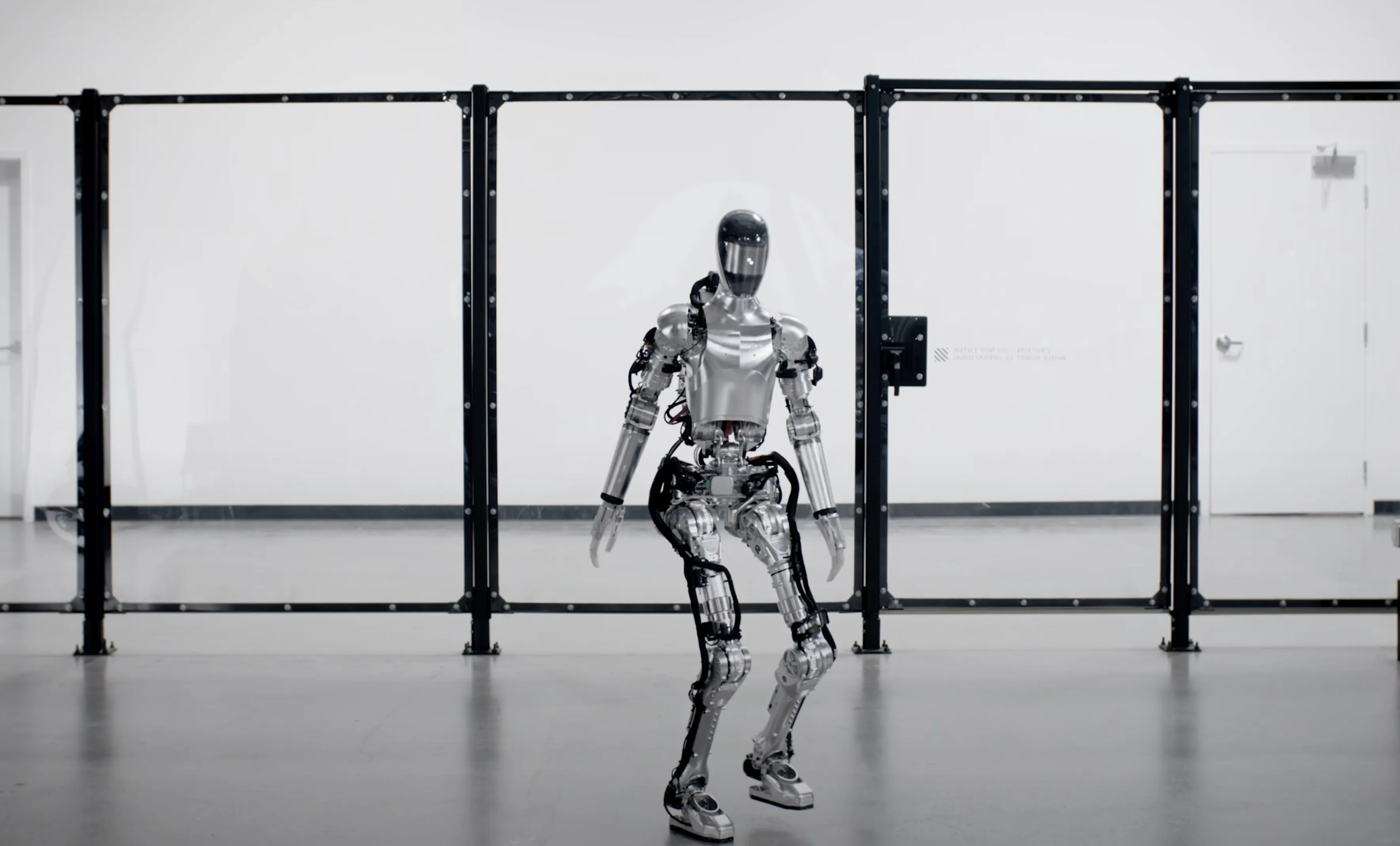

The launch of “AtlasX” further solidified the Figure Stock Robot brand. AtlasX’s machine-learning core improved with every deployment, showcasing the true value of continuous data feedback.

?? Market Performance & Valuation

Following the IPO, Figure Stock saw its market cap soar to $2.3B. Analysts plotted the Figure Stock Chart and noted a bullish trend. This growth outpaced many peers, turning heads among portfolio managers seeking a six figure stock portfolio entry.

Dividend strategies are emerging. Investors learning how to Figure Stock Dividends anticipate payouts in 2026, aligning with profitability targets set in late 2024.

?? Future Outlook & Strategic Vision

Looking ahead, Figure Stock plans to expand into consumer robotics by 2026. Their roadmap includes home assistants and personal care bots. Many anticipate a secondary offering under Figure AI Stock IPO to fund global rollouts.

With R&D centers in Silicon Valley and Shenzhen, the company is poised to challenge legacy giants. Tracking the Figure AI Stock Ticker daily has become a ritual for growth investors.

?? Summary

Figure Stock transformed from a bold startup into an industry leader by focusing on modular AI, strategic partnerships, and aggressive funding. Its robust performance, highlighted by strong Figure Stock Name recognition, makes it a standout in both robotics and tech investment circles.

Whether you’re a seasoned trader or robotics enthusiast, the Figure Stock journey offers lessons in innovation, market timing, and the power of open collaboration.

? Frequently Asked Questions

What is the current Figure Stock Price?

The latest price fluctuates with market conditions. Check your brokerage for real-time quotes.

How can I buy Figure Stock?

Open an account with any major brokerage and search the Figure Stock Symbol “FGR”.

When did Figure Stock IPO take place?

The IPO was completed in June 2023, raising $120M for expansion.

Is Figure Stock a good dividend investment?

Dividends are expected by 2026 once profitability stabilizes, offering income potential.

What makes Figure Stock AI unique?

Its modular AI architecture allows seamless integration with third-party hardware, driving rapid innovation.