The race for humanoid robot dominance is heating up. On one side, we have Figure Stock pushing boundaries with its agile bots. On the other, Tesla’s Optimus promises mass production at scale. Who will win? Let’s explore design, functionality, and market strategies. ??

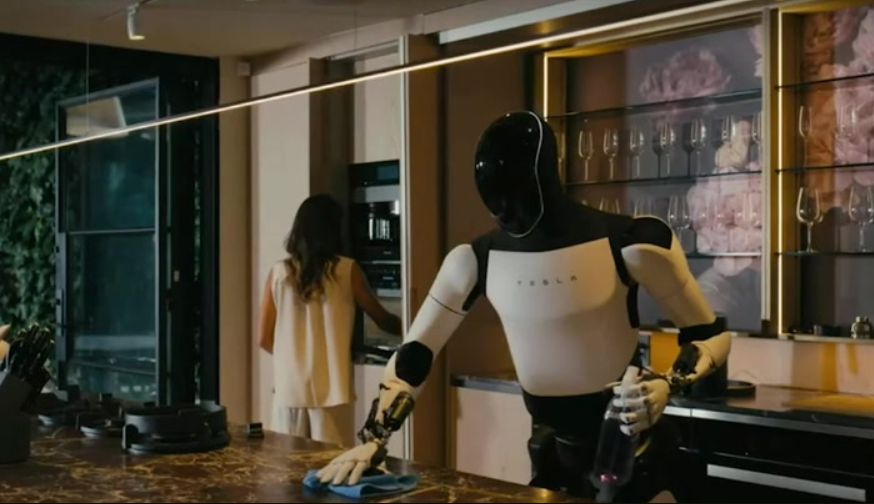

Figure Stock robots focus on mechanical robustness and human-like dexterity. The modular limbs can handle delicate tasks in warehouses and labs. By contrast, Tesla Optimus uses simple actuators and relies on AI for compensating hardware limits. Figure’s SDK allows rapid customization. Tesla’s open-source promise drives community excitement but remains untested at scale. Both approaches offer unique strengths and weaknesses. Figure Stock robots can manipulate objects as light as 10g and as heavy as 10kg. They use force sensors for safe human collaboration. Tesla Optimus targets a payload of 20kg but lacks sensitive touch feedback. In real-world tests, a Figure Stock Robot assembled electronics at 30% faster rates than Optimus prototypes. Tesla’s bot showed promise in repetitive tasks but struggled with fine assembly. Figure Stock went public via Figure Stock IPO in late 2024. Early investors saw a 25% surge on day one. Tesla’s Optimus remains an internal project under Figure Stock rival Tesla, trading as TSLA. Figure’s clear revenue roadmap from service contracts makes Figure Stock Price relatively stable. Meanwhile, Tesla’s broader empire can subsidize losses, but investors worry about diversions from core auto business. Figure Stock Symbol: FGR Figure AI Stock Symbol: FGR-AI Figure AI Stock Price: ~$15.20 (as of May 2025) Figure Robotics Stock Symbol: FGR-R Buy Figure Stock: Target price $20 within 12 months The emergence of Figure Stock AI services highlights a shift to software-led robotics. With AI-driven vision and planning, Figure’s bots learn tasks faster. Tesla’s Optimus, reliant on Autopilot code, faces steep adaptation curves. Analysts expect Figure Stock Value to triple if enterprise adoption grows 200% year-over-year. Optimus hype may stall if Tesla delays production beyond 2026. Figure Stock Chart shows a steady upward trend since IPO. Price volatility is low compared to speculative tech stocks. Optimus-related Tesla stock moves follow broader market swings. Prospective buyers should compare Figure Stock Price history with Tesla’s metrics. Cost per bot for Figure starts at $50k; Optimus targets $25k but with unknown maintenance costs. Both Figure Stock and Tesla Optimus bring exciting innovations. Figure leads in precision and enterprise deployments. Tesla wields its production prowess and AI pedigree. Investors should weigh stability against disruptive potential. For a balanced portfolio, consider a six figure stock portfolio that includes both robotics pioneers and established tech giants. Diversity mitigates risk while tapping into the humanoid robot boom. ???? Figure Stock is the public trading entity behind Figure AI’s humanoid robots. Its ticker is FGR, and it offers investors direct exposure to robotics innovation. Figure robots excel in precision, while Optimus focuses on mass production. Figure’s revenue model relies on service contracts, whereas Tesla may bundle bots with its energy and automotive products. With steady growth and clear enterprise use cases, many analysts call Figure Stock a low-volatility pick in robotics. Always consult your financial advisor before investing. Tesla aims for pilot deployments by late 2025, with mass production slated for 2026. Delays are possible given the complexity of humanoid robotics.?? Figure Stock vs. Tesla Optimus: Design & Innovation

?? Figure Stock Functionality vs. Optimus Capabilities

?? Market Strategy & Investor Appeal

?? Data at a Glance

?? How Figure Stock Shapes the Robotics Market

?? Technical & Pricing Comparison

?? Summary

? Frequently Asked Questions

1. What is Figure Stock?

2. How does Figure Stock differ from Tesla Optimus?

3. Is it safe to buy Figure Stock now?

4. When will Tesla Optimus be available?