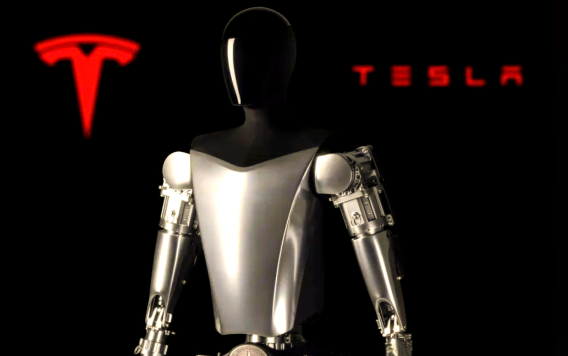

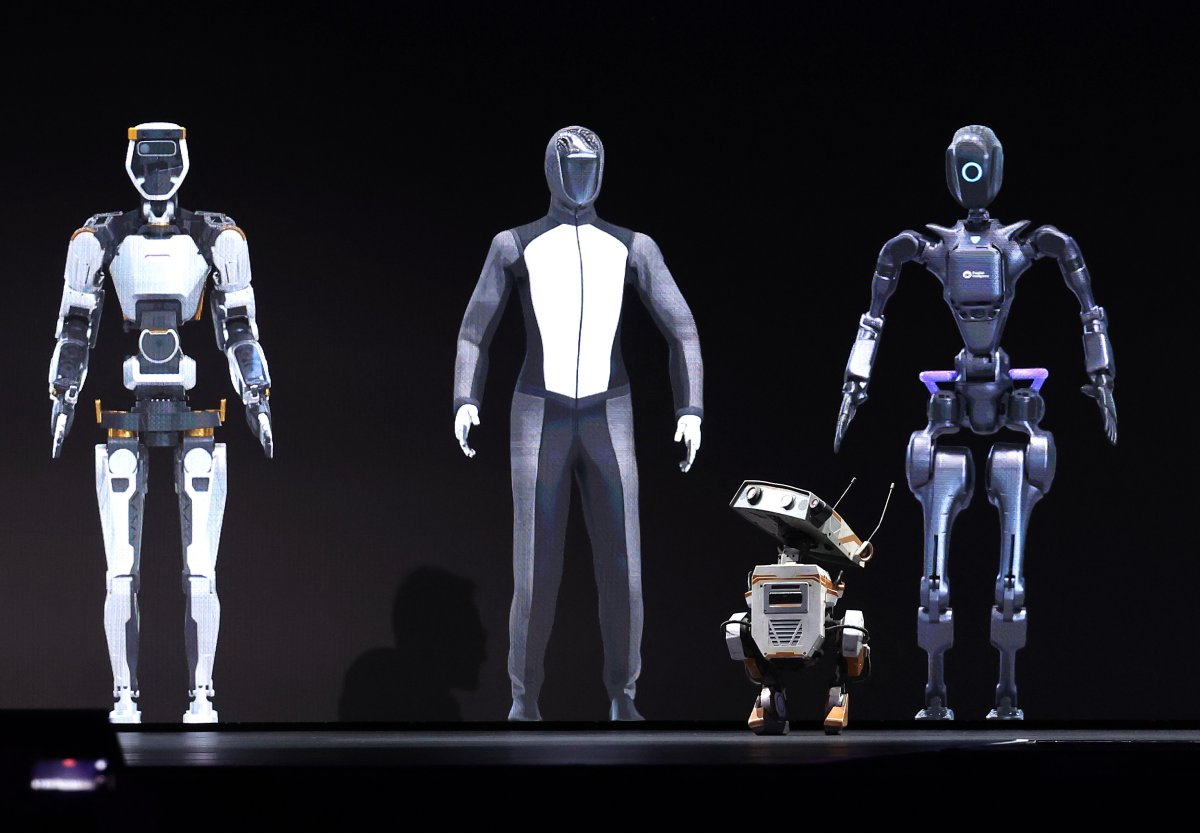

In recent years, Figure Stock has captured headlines with its rapid expansion and impressive funding rounds. Investors are taking note of this groundbreaking company, driving a wave of enthusiasm across the entire robotics sector. This article unpacks how Figure Stock growth is reshaping investment strategies, influencing related firms, and paving the way for humanoid robotics breakthroughs.

1. The Rise of Figure Stock and Investor Enthusiasm

Figure Stock caught the market’s eye when it announced its successful Figure Stock IPO in late 2024. Backed by significant Series B funding, the company’s valuation soared, signaling to investors that robotics could rival traditional tech sectors in return potential. Early backers who monitored the Figure Stock Price trajectory saw gains north of 40% within months of the IPO.

Beyond the IPO, Figure Stock Symbol “FIGR” has become a staple on watchlists. Its cloud-based AI control systems have led many to label it a Robust Stock pick for diversifying portfolios. Compared to established names like Kubrick Stock and even SpaceX Stock, Figure Stock offers a unique play in robotics-specific growth.

1.1 Funding Milestones and Figure Stock Gains

By Q1 2025, Figure Stock had completed a $150 million venture round, boosting working capital for R&D in humanoid prototypes. The hype around the 1X Stock valuation metric underscored its rapid ascent. Analyst forecasts project further upside as the company scales manufacturing.

Expert Quote

“Figure Stock represents a turning point for robotic automation, blending AI finesse with practical deployment,”

— Dr. Emily Carter, Robotics Investment Analyst

2. Ripple Effects on the Robotics Sector

The surge of Figure Stock has spurred investors to explore other robots-as-a-service models. Names like Figure Stock Robot and startups using Figure Stock AI controls are now securing seed funding faster than ever. This trickle-down effect has energized venture capital firms to scout for the next big robotics unicorn.

Several public companies have seen their valuations tick upward after announcing partnerships or joint ventures with Figure Stock. Even traditional manufacturing firms have allocated budgets to test prototypes from firms carrying the label Figure Stock Value enhancers. It’s clear that market sentiment is shifting towards automation.

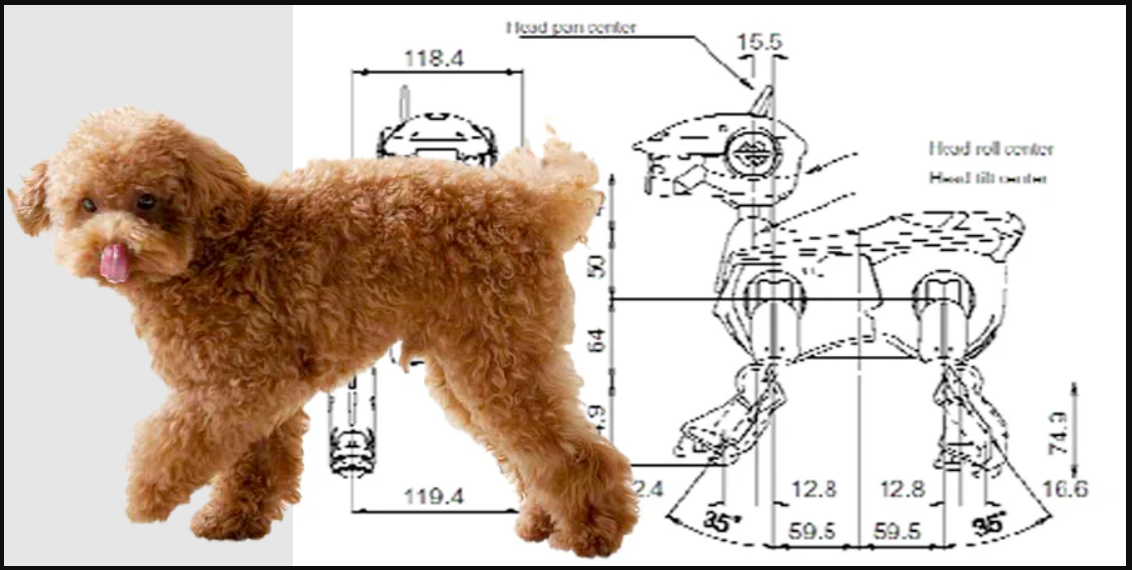

2.1 Humanoid Robotics on the Horizon

Interest in humanoid applications—ranging from logistics to eldercare—has surged thanks to Figure Stock prototypes demonstrated at trade shows. These demos showcased robots handling delicate tasks, prompting comparisons to classic Figure Robotics Stock Symbol plays.

Case Study

A leading delivery firm piloted Figure Stock-powered bots in its warehouses, cutting labor costs by 22% and boosting throughput by 18%.

Point Analysis

Cost savings: 22%

Efficiency gains: 18%

Scalability potential: High

3. Future Outlook and Investment Potential

As we look ahead, Figure Stock shows no signs of slowing down. Analysts recommend adding a small allocation of Buy Figure Stock positions for growth-focused portfolios. Its R&D pipeline includes advanced locomotion and object manipulation features, which are critical for commercial adoption.

Moreover, seasoned investors are now discussing how to How to Figure Stock Dividends schemes into their strategy once the company mints consistent free cash flow. While dividends aren’t imminent, the potential for yield-based returns adds an extra layer of appeal for conservative backers.

3.1 Strategic Considerations

Investors weighing Figure Stock must consider competition from legacy robotics leaders and emerging new entrants. However, early adoption advantages could cement its place as a top-tier pick in a diversified six-figure portfolio focused on automation.

Summary

In summary, the meteoric rise of Figure Stock is reshaping the robotics investment landscape. Its IPO success, robust funding rounds, and strong technology demos have catalyzed interest across the sector. From expert endorsements to real-world case studies, the impact of Figure Stock is undeniable. As the company advances its humanoid offerings, investors are wise to keep this name front and center in their robotics allocations. ??

FAQs

Q1: What makes Figure Stock stand out?

Figure Stock stands out due to its cutting-edge AI integration and strong funding history, which have accelerated humanoid robotics development.

Q2: How can I track Figure Stock performance?

You can follow the Figure Stock Chart on major trading platforms or set alerts for movements in the Figure Stock Price.

Q3: Is it too late to invest in Figure Stock?

While early investors saw rapid gains, Figure Stock still has a long runway with upcoming product launches and revenue milestones on the horizon.