In the rapidly evolving world of automation, Robot Companies are at the heart of transformation. From agile newcomers to industrial stalwarts, competition is fierce. This article pits nimble startups against established giants to uncover who truly drives breakthroughs in AI-driven robotics.

Robot Companies on the Frontier: Agile Startups Driving Innovation

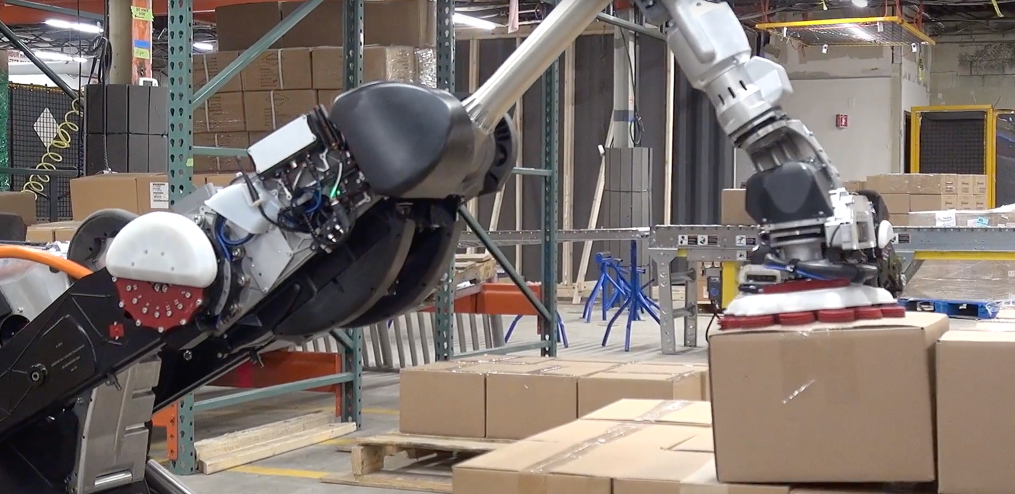

Startups like AI Robot Companies Covariant and Neurala raised a combined $12.4 billion in 2023, fueling fast-paced research and development. These Robot Companies excel at rapid prototyping, leveraging lean teams to iterate AI models in days instead of months. Their focus on specialized tasks—such as warehouse picking or visual inspection—allows them to deliver niche solutions ahead of the curve.

Covariant’s AI–powered arms learn new products in hours, not weeks, while Neurala’s deep-learning vision systems adapt on the fly. These feats highlight why many view startups as the innovation engine of modern robotics.

Legacy Leaders: How Giants in Robot Companies Maintain Their Edge

Established names like ABB and KUKA account for 45% of the industrial robotics market, thanks to decades of experience in manufacturing automation. These industrial robot companies boast extensive service networks, global supply chains, and robust safety standards.

ABB’s YuMi robot handles delicate assembly tasks in electronics, while KUKA’s KR series empowers heavy-duty welding and palletizing. Such reliability makes them the go-to choice for high-volume production lines worldwide.

Swarm Robotics: The Next Niche Battleground for Robot Companies

Beyond single-unit machines, both startups and giants explore swarm robotics—coordinated fleets of small robots tackling large tasks collectively. Swarm algorithms promise scalability in search-and-rescue, agriculture, and logistics.

For instance, Neurala’s research on drone swarms demonstrates autonomous formation flying, while ABB’s swarm prototypes optimize solar panel cleaning in deserts. These collaborative systems could redefine industry standards.

Head-to-Head Comparison: Startups vs Giants

Speed to Market: Startups often release pilot projects within weeks; giants follow multi-year validation cycles.

Scalability: Giants leverage vast production lines; startups excel in bespoke, adaptable deployments.

Risk Tolerance: Startups embrace cutting-edge AI at the risk of early failures; established Robot Companies prioritize proven safety.

Support Ecosystem: Giants offer global maintenance; startups rely on cloud updates and remote diagnostics.

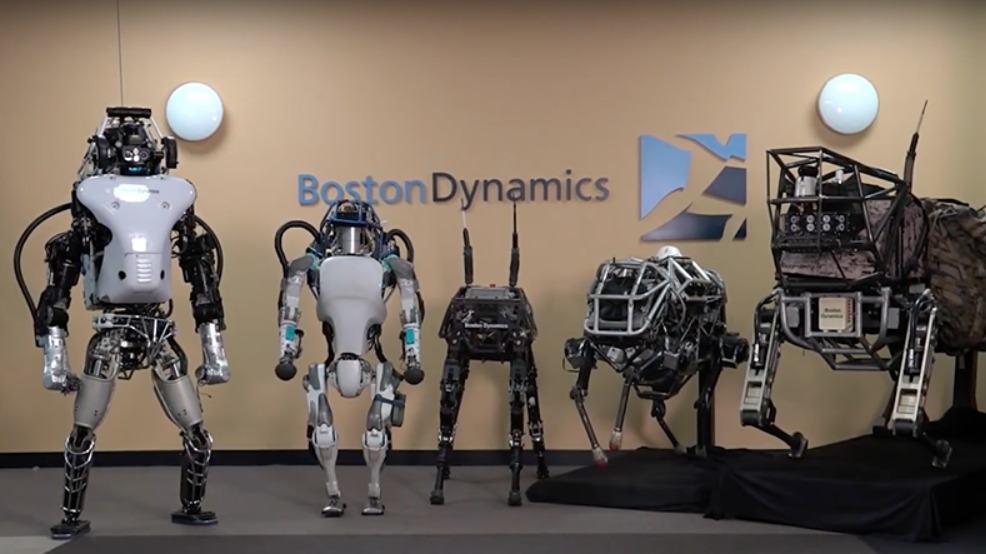

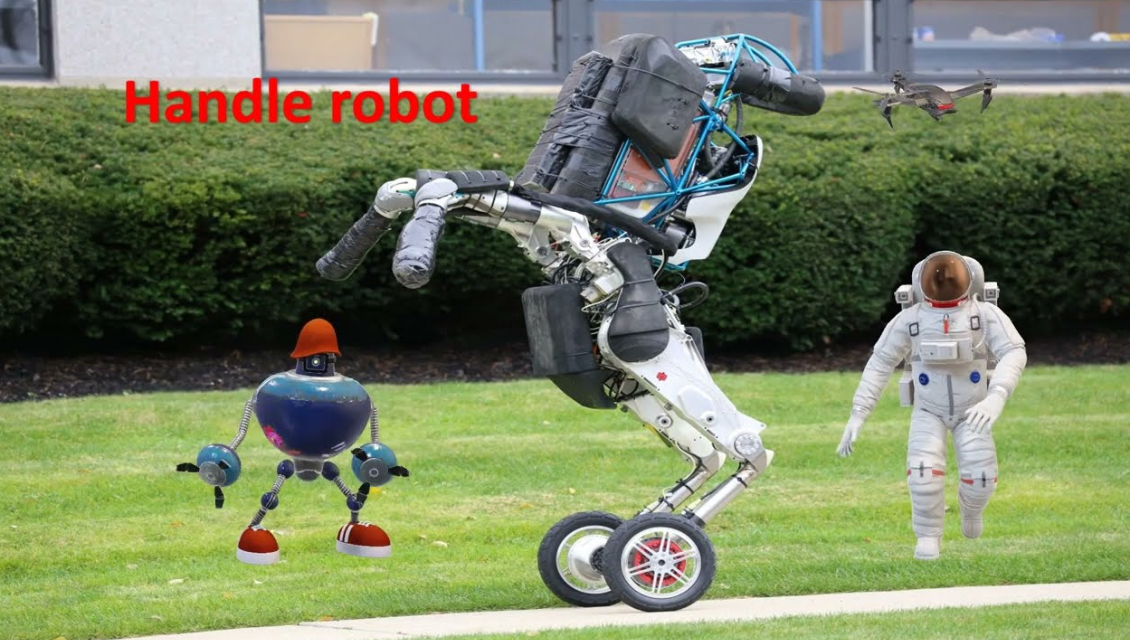

Special Mentions: Humanoid Robot Companies and Boston Dynamics

While most players focus on industrial arms, humanoid robot companies are carving their own niche. Boston Dynamics reigns supreme here, with its agile Atlas platform and signature Spot robot.

Spot’s versatility—in security, inspection, and research—demonstrates how legged robots can traverse uneven terrain where wheels fail. This unique capability underscores why Boston Dynamics Spot remains a standout brand in both R&D labs and commercial trials.

Global Reach: Robot Companies Around the World

Innovation isn’t confined to Silicon Valley. Japanese robot companies like FANUC and Yaskawa excel in precision manufacturing. In India, emerging robotics companies in India integrate local expertise with global AI frameworks. Even robot companies in Canada are harnessing research from top universities to spawn new ventures.

This worldwide competition accelerates progress, as regional specialties contribute to the broader robotics ecosystem.

Summary: Who’s Winning the Robot Companies Innovation Race?

Agile startups push boundaries with rapid AI prototyping, while industry giants deliver scale, reliability, and safety. Niche fields like swarm and humanoid robotics blur the lines between the two camps. Ultimately, collaboration—through partnerships or acquisitions—may define the next era of breakthroughs.

As both startups and established Robot Companies continue to evolve, end users stand to benefit from a blend of cutting-edge innovation and proven performance.

FAQs

What Are the Top Robot Companies to Watch?

Look for fast-growing startups like Covariant and Neurala alongside established names such as ABB, KUKA, and Boston Dynamics.

How Do Robot Companies Compare in Funding?

In 2023, robotics startups raised $12.4 billion, while giants self-fund most R&D through revenue reinvestment.

Are There Robot Companies Near Me?

You can find robotics companies near me by checking local tech hubs, university incubators, and trade shows.

Which Robot Companies Lead in Industrial Automation?

ABB and KUKA dominate the industrial segment, controlling about 45% of the market share as of 2023.