In recent years, AI-powered creative platforms like Udio have gained massive popularity. Musicians, producers, and creators worldwide are turning to Udio for cutting-edge AI-assisted music and video generation. Naturally, many investors and users alike wonder: Is Udio publicly traded? And if so, what’s the status of Udio stock in the market?

This article explores the current state of Udio’s corporate structure, clarifies whether you can buy Udio stock, and analyzes the investment potential in this growing sector. If you’re curious about investing in AI creativity platforms or simply want to understand Udio’s market position, this guide is for you.

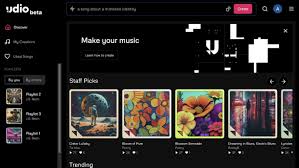

What Is Udio? A Quick Overview

Before we get into stock details, it’s helpful to understand what Udio is and why it matters. Udio is a real, fast-growing AI-driven platform that enables users to create music and video content through generative AI tools. The platform combines:

Advanced AI algorithms

User-friendly interfaces

Versatile options for music style, vocal types, and video generation

Udio has been praised for its intuitive design and professional-quality outputs, attracting a diverse user base from hobbyists to industry professionals.

Is Udio Publicly Traded?

As of August 2025, Udio is not publicly traded on any major stock exchange such as NASDAQ, NYSE, or the London Stock Exchange. It remains a privately held company, focusing on product development and market expansion rather than public equity offerings.

There are no public listings or ticker symbols available for Udio stock at this time, which means individuals cannot directly purchase shares of Udio through traditional stock markets.

Why Isn’t Udio Publicly Traded Yet?

Several reasons explain why Udio has not gone public:

Early-Stage Growth: Udio is still in an aggressive growth phase, investing heavily in R&D and platform improvements. Going public requires stable revenue streams and proven profitability, which may still be in development.

Private Funding Success: Many AI startups, including Udio, prefer to raise funds through private venture capital rounds to maintain control and flexibility. This often includes backing from strategic investors specializing in AI technology.

Market Timing: Going public involves regulatory complexities and market conditions. Udio’s leadership may be waiting for an optimal moment to launch an IPO or consider alternative public listing methods such as SPAC mergers.

Alternatives for Investing in Udio

While you cannot buy Udio stock directly, investors interested in the AI music and creative tech space have alternative options:

Invest in Parent or Partner Companies: If Udio is owned or partnered with larger tech firms, sometimes those companies are publicly traded. Tracking their stock indirectly exposes you to Udio’s growth.

Invest in AI and Creative Tech ETFs: Exchange-traded funds focusing on artificial intelligence, cloud computing, or media technology often include companies like Udio’s competitors or ecosystem partners.

Venture Capital Funds: Accredited investors may find private equity or venture capital funds investing in AI startups, including platforms similar to Udio.

Udio’s Growth and Market Potential

Although Udio isn’t publicly traded, its market potential is enormous:

The global AI music generation market is expected to grow at a CAGR exceeding 30% through 2030.

Increasing demand for AI-assisted creative tools in entertainment, advertising, and gaming sectors drives innovation.

Udio’s commitment to user experience and expanding feature sets position it as a front-runner in AI creative platforms.

Such growth often precedes public offerings and may hint at Udio’s potential future IPO or acquisition.

What to Watch: Signs Udio Might Go Public

If you’re keen on eventually investing in Udio, keep an eye on these indicators:

Funding Rounds: Large Series C or D funding rounds often precede IPO announcements.

Partnership Announcements: Collaborations with publicly traded companies can signal market readiness.

Hiring and Expansion: Significant expansion in management or corporate functions often hints at IPO preparations.

Regulatory Filings: If Udio files S-1 documents with the SEC or equivalent agencies, that marks an upcoming IPO.

Risks of Investing in AI Music Platforms

Before diving into investments, it’s essential to understand risks involved in AI music tech companies like Udio:

Market Competition: AI music is crowded with competitors including Amper Music, Aiva, Soundraw, and OpenAI’s Jukebox.

Regulatory Challenges: Copyright laws and ethical issues regarding AI-generated content could impact operations.

Technological Uncertainty: Rapid changes in AI technology can disrupt current platforms.

Financial Performance: Early-stage startups often face fluctuating revenues and heavy expenses.

Balancing optimism with caution is key for any investor.

Conclusion: What Does the Future Hold for Udio Stock?

To sum up, Udio is currently a private company with no publicly traded stock available. However, its innovative platform, growing user base, and strong market trends make it a noteworthy company in AI music and video generation.

Investors interested in this space should watch Udio’s funding and growth closely, as it could become a publicly traded entity in the coming years. Until then, exploring alternative investment vehicles related to AI and creative technologies can offer indirect exposure.

As AI continues to transform the creative industries, platforms like Udio are poised to play significant roles, making them important companies to watch for future investment opportunities.

Frequently Asked Questions (FAQs)

Q1: Can I buy Udio stock on the stock market?

A: No, Udio is a privately held company and is not publicly traded as of 2025.

Q2: When might Udio go public?

A: There’s no official timeline, but it could consider an IPO once it reaches stable revenue and market conditions improve.

Q3: Are there similar companies to Udio that are publicly traded?

A: Yes, companies involved in AI, music technology, and creative platforms may be publicly traded and can provide indirect exposure.

Q4: How can I stay updated about Udio’s financial status?

A: Follow their official announcements, press releases, and monitor venture capital news related to AI startups.

Q5: Is investing in private AI companies risky?

A: Yes, private startups carry higher risks but can offer substantial rewards if successful.

Learn more about AI MUSIC