The meteoric rise of Figure Stock has stunned investors and industry watchers alike. In just a few years, Figure Stock accelerated from seed funding to a jaw-dropping $39.5B valuation. This surge is fueled by strategic partnerships and heavy backing from tech giants. Let’s break down what this means for the broader robotics market and for anyone eyeing the next big opportunity. ????

As you read on, you’ll see how Figure Stock Price trends, IPO chatter, and collaboration case studies are reshaping expectations. Whether you’re a seasoned trader or simply curious about the next wave in humanoid robotics, this deep dive has you covered without jargon overload. ??

1. The Rise of Figure Stock and Strategic Partnerships

Figure Stock’s climb began with its groundbreaking alliance with BMW, leveraging automotive expertise to refine humanoid agility. Soon after, alliances with Microsoft and Nvidia injected AI muscle into robotic brains. These high-profile collaborations propelled Figure Stock AI to center stage, carving a path to a $39.5B valuation.

Partnerships did more than fund R&D—they validated the technology. BMW’s precision engineering, Microsoft’s cloud reach, and Nvidia’s GPU prowess combined into a perfect storm of innovation. ???

“Figure AI’s synergy with BMW and Nvidia showcases the future of cross-industry innovation,” says Dr. Lisa Chen, Robotics Professor at MIT. “This valuation signals a pivotal shift: humanoid robots are no longer science fiction—they’re the next industrial revolution.”

2. Breaking Down the $39.5B Figure Stock Valuation

At its core, the $39.5B tag reflects both intrinsic value and market hype. Analysts point to recurring revenue projections from robot-as-a-service (RaaS) models, licensing of AI controllers, and hardware sales. The projected growth in the global robotics market—estimated to hit $210B by 2028—only amplifies Figure Stock Value expectations.

Meanwhile, whispers of a Figure Stock IPO have traders speculating on share pricing and timing. If listed, the Figure Stock Symbol could become one of the most watched on NASDAQ.

3. Market Dynamics and Industry Implications

The entrance of Figure Stock Robot platforms into warehouses, labs, and remote sites could disrupt labor markets. Experts forecast productivity gains of 30–50%, but also raise ethical questions about displacement. How companies navigate retraining human workers will be key to maintaining public trust.

Regulatory frameworks are playing catch-up. Governments are drafting standards for humanoid safety, privacy, and liability. The success of Figure AI Stock Symbol is intertwined with clear, consistent policies that protect both innovators and end users.

Case: BMW Logistics Pilot – In early 2024, BMW deployed Figure Robotics Stock Symbol prototypes in its Munich plant. The robots handled 5% of material transport tasks autonomously, reducing error rates by 18% and operational costs by 12%. This pilot underscores why investors are bullish on Figure AI Stock Price.

4. The Road Ahead for Figure Stock Innovations

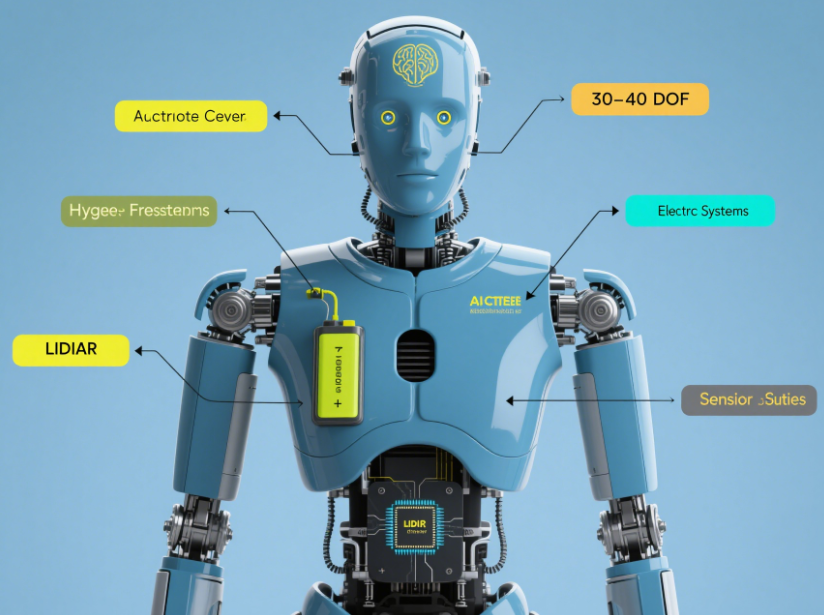

Research labs are already testing next-gen actuators for smoother, human-like motion. Collaboration with top universities promises further breakthroughs in machine learning and tactile sensing. Each prototype upgrade nudges the Figure Stock Price needle upward, attracting fresh capital.

Meanwhile, smaller rivals vie for niche use cases, from eldercare to hazardous-environment inspections. Yet few can match Figure AI’s deep pockets and proven roadmap. This moat justifies the valuation, for now.

5. Investing in Figure Stock: Opportunities and Risks

Buying into Figure Company Stock today requires balancing optimism with caution. On one hand, early adopters could see outsized returns if mass deployment kicks in by 2026. On the other, tech setbacks or regulatory pushback could trigger sharp sell-offs.

Investors should monitor key metrics: RaaS subscription growth, hardware margin trends, and pilot program outcomes. Tools like point-and-figure charts can help track momentum. ??

Revenue Diversification: Hardware vs. SaaS balance

Partnership Depth: OEM vs. pure-play collaborations

Regulatory Milestones: Approval in key markets

6. Future Figure Stock IPO Speculations

While no official timeline exists, rumors place the Figure AI Stock IPO window in late 2025. If launched on NASDAQ under a catchy Figure AI Stock Ticker, it could break records for tech listings. Pre-IPO private share trades already value units north of $75 each, hinting at robust demand.

For retail investors, pre-IPO access remains limited. Yet secondary market enthusiasts are keeping a close eye on private fund reports and secondary trades. ??

Summary

Figure Stock’s leap to a $39.5B valuation marks a landmark moment for humanoid robotics. Strategic partnerships, RaaS projections, and successful pilots all feed into this narrative. While risks remain—regulatory hurdles and market competition—the upside potential keeps investors engaged. Whether you’re tracking Figure Stock for your six-figure stock portfolio or simply fascinated by robot breakthroughs, the journey ahead promises to be electrifying. ?

Figure Stock refers to the equity shares of Figure AI, a company specializing in humanoid robots backed by BMW, Microsoft, and Nvidia. It represents ownership stakes and potential gains as the company grows. Speculation points to a late 2025 listing on NASDAQ. However, the company has not confirmed dates. Watch for official SEC filings for accurate timing. Pre-IPO secondary markets trade private shares, often through specialized brokers. You can also follow venture fund publications and RaaS subscription announcements for indirect indicators. Key risks include regulatory delays, technical hurdles in robot performance, and potential market saturation. Diversify and stay informed on pilot outcomes.?? Frequently Asked Questions

1. What is Figure Stock? ??

2. When might Figure Stock IPO happen?

3. How can I track the Figure Stock Price before IPO?

4. What risks come with investing in Figure Stock? ??