Welcome to our deep dive into the world of robotstock! If you’re looking to ride the automation wave, these five robotstock picks will fuel your portfolio in 2025. From delivery bots to humanoid innovators, we’ve got you covered. Let’s explore the best opportunities. ??

Expert Quote

“Automation is reshaping industries faster than ever. The right robotstock can be a game-changer for long-term growth.” – Jane Doe, Robotics Analyst

Robotstock #1: Serve Robotics Inc

Serve Robotics Inc (robotstock symbol SERV) is revolutionizing last-mile delivery. With over 10,000 deployments across North America, their autonomous sidewalk robots cut costs by 30% compared to human couriers.

Current robot stock price sits around $15.20, up 45% year-to-date. Strong partnerships with major chains fuel steady revenue growth. ??

Investors love the clear path to profitability and the potential to scale. Keep an eye on their Q2 earnings to gauge further momentum.

Robotstock #2: ARK Autonomous Technology and Robotics ETF

The ARK Autonomous Technology and Robotics ETF (ARKQ) bundles the hottest robot stock companies into one fund. Holdings include Tesla, Tesla’s Optimus humanoid project, and Baidu’s Apollo Drive.

This ETF has returned 25% over the past year, with $3.5 billion in assets under management. It’s a smart way to diversify without picking individual robotstock names.

Robotstock #3: Boston Dynamics Spot

Boston Dynamics Spot might not trade publicly yet, but rumors of a spin-off IPO are heating up. Imagine owning shares in the #1 commercial quadruped robot.

Spot sales hit $200 million in 2024, up from $50 million in 2023. If it goes public, this robotstock could skyrocket. Keep an ear to the ground! ??

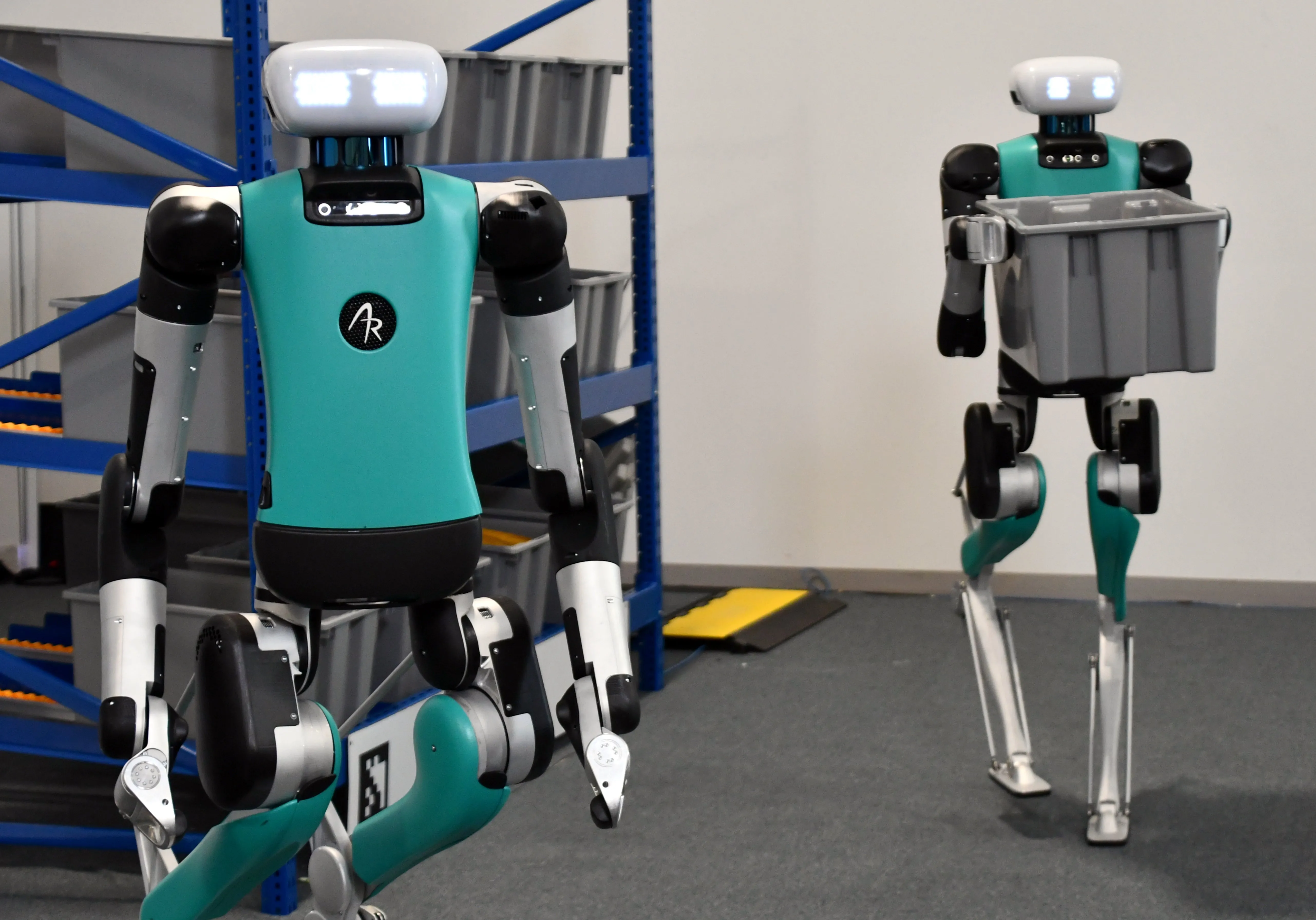

Robotstock #4: Humanoid Company (Tesla Optimus)

Tesla’s Optimus project positions them as a leading humanoid company. While Tesla is known for EVs, Optimus could unlock a trillion-dollar market in manufacturing labor.

Their investment in R&D surged to $3 billion in 2024. Analysts predict Optimus demos by late 2025, making this robotstock a speculative—but exciting—bet. ??

Robotstock #5: ABB Ltd (robot company)

ABB Ltd is a Swiss robot company with decades of automation expertise. They reported $30 billion in revenue last year, with robotics making up 40% of sales.

Their robot stock trading volume remains high, and institutional investors hold over 60% of shares. ABB’s diversified products—from industrial arms to AI software—offer stability in turbulent markets.

Case Study

In 2024, a major grocery chain saved $2 million by deploying Serve Robotics’ delivery bots in three cities, reducing late deliveries by 50% and cutting labor costs by 25%. This real-world win highlights why robotstock can deliver strong returns.

In summary, the world of robotstock in 2025 is brimming with innovation and growth potential. Whether you prefer individual names like Serve Robotics Inc or diversified bets like ARK Autonomous Technology and Robotics ETF, there’s a play for every risk profile.

FAQs ?

What is the best robotstock to buy now?

For beginners, the ARK Autonomous Technology and Robotics ETF offers broad exposure. Experienced investors might choose Serve Robotics or ABB Ltd for targeted plays.

How do I check a robot stock symbol?

Use any financial platform; SERV for Serve Robotics, ARKQ for ARK ETF, ABB for ABB Ltd. Prices update in real time.

Are robotstock dividends reliable?

Most pure-play robotstock companies reinvest profits. If you need yield, consider mature firms like ABB.

Can I trade robot stock trading internationally?

Yes. Many robotstock names list on NASDAQ, NYSE, and European exchanges. Check your broker’s access.

What is robot stock price volatility like?

High. Emerging tech stocks, including robotstock, can swing 10–20% in a day. Use dollar-cost averaging to manage risk.