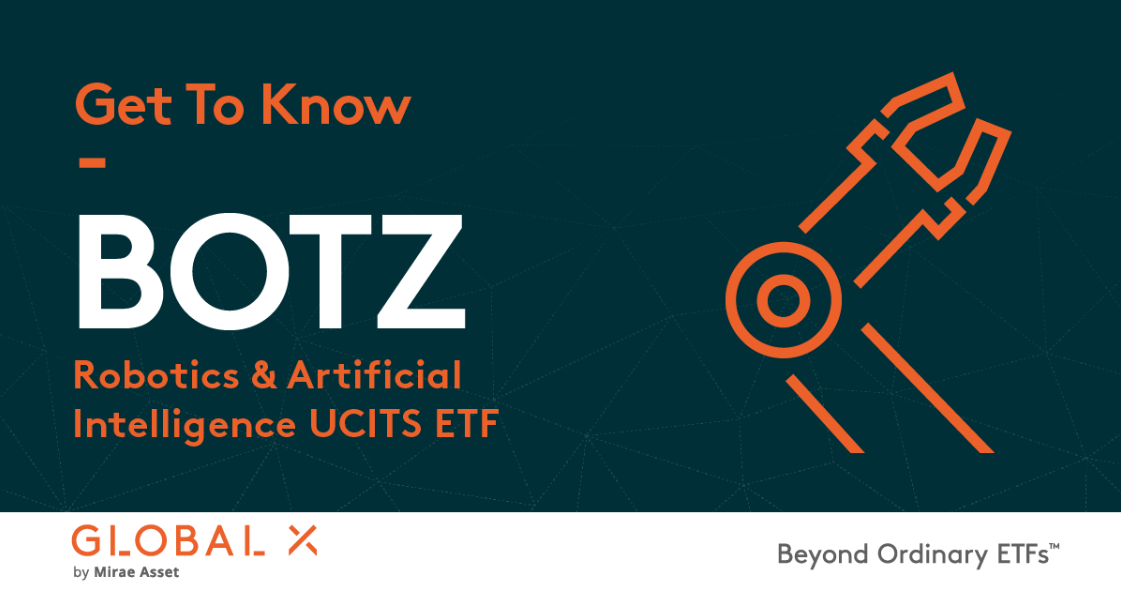

The Global X Robotics & Artificial Intelligence ETF (BOTZ) is an innovative exchange-traded fund that provides investors with exposure to companies driving advancements in robotics, automation, and artificial intelligence (AI). The ETF invests in a basket of global companies involved in these cutting-edge technologies, aiming to capture the growth potential of industries like robotics, automation, and AI.

Global X Robotics & Artificial Intelligence ETF Review

When considering the Global X Robotics & Artificial Intelligence ETF for your investment portfolio, it’s essential to understand its composition and performance. The fund tracks the INDXX Global Robotics & Artificial Intelligence Thematic Index, which includes companies from a variety of sectors such as industrials, technology, and consumer goods. The focus is on companies that are leading innovation in areas like robotics, AI, and automation.

How Does the Global X Robotics & Artificial Intelligence ETF Work?

The Global X Robotics & Artificial Intelligence ETF invests in stocks of companies that are heavily involved in robotics and AI technologies. These companies are developing or utilizing robotics and automation to enhance productivity and solve complex challenges across multiple industries. Some of the major players in the ETF include leaders in manufacturing automation, autonomous vehicles, and AI-driven solutions.

With its BOTZ ETF, Global X offers a targeted investment opportunity for those looking to capitalize on the rapid growth of AI and robotics. For example, one of the best-known companies within the ETF is Vanguard Global X Robotics & Artificial Intelligence ETF, which offers solid exposure to companies making technological strides in these fields.

Global X Robotics & Artificial Intelligence ETF Share Price and Stock Performance

The Global X Robotics & Artificial Intelligence ETF stock price has demonstrated growth potential over the years, reflecting the rising demand for automation and robotics solutions. The Global X Robotics & Artificial Intelligence ETF ticker (BOTZ) can be tracked on most major financial platforms. Investors can monitor the Global X Robotics & Artificial Intelligence ETF chart to observe its performance over time and make informed decisions based on trends in the robotics and AI sectors.

Despite fluctuations in the market, the ETF has remained a strong performer, particularly as the demand for autonomous technology increases. Moreover, the Global X Robotics & Artificial Intelligence ETF dividend structure is appealing to income-focused investors, with regular payouts tied to the performance of the underlying companies.

Who Owns the Global X Robotics & Artificial Intelligence ETF?

The Global X Funds, which manages the Global X Robotics & Artificial Intelligence ETF, is owned by a team dedicated to creating thematic and sector-specific ETFs. The Global X Robotics & Artificial Intelligence ETF is part of a larger trend toward specialized ETFs designed to target high-growth industries, such as cloud computing, autonomous vehicles, and robotics.

Is the Global X Robotics & Artificial Intelligence ETF Right for You?

Investing in the Global X Robotics & Artificial Intelligence ETF is a way to gain exposure to the emerging technologies of the future. If you believe in the long-term potential of robotics, automation, and AI, this ETF provides a solid platform for growth. However, as with any investment, it's important to consider your personal financial goals and risk tolerance before diving in.

The Global X Robotics & Artificial Intelligence ETF review generally shows a positive outlook, but investors should always be aware of the inherent risks in the tech and innovation sectors. Whether you are looking at the Global X Robotics & Artificial Intelligence ETF Vanguard options or exploring the fund’s other benefits, it’s clear that this ETF offers significant growth potential in the evolving world of robotics and AI.

Conclusion

The Global X Robotics & Artificial Intelligence ETF represents an exciting opportunity for those looking to invest in the future of automation, robotics, and AI. With a strong underlying index, a diverse mix of global companies, and growth potential across several high-demand sectors, the BOTZ ETF is a standout in the world of tech-focused ETFs.