Spotify has transformed from a Swedish startup in 2006 into the world’s leading music streaming service with over 600 million active users as of Q1 2025. For investors, the central question is: what is the Spotify stock forecast, and is Spotify stock expected to go up?

With Spotify’s ticker symbol SPOT trading on the New York Stock Exchange since 2018, it has drawn attention from both institutional and retail investors. Its performance has been volatile, driven by growth in users, profitability challenges, and shifts in the global music industry. In this article, we’ll dive into Spotify’s financials, growth prospects, risks, and expert forecasts to evaluate its potential.

Spotify (NYSE: SPOT) has historically operated at a loss, reinvesting heavily in growth, but recent years show signs of financial improvement.

Revenue Growth: Spotify reported €14.6 billion ($15.8 billion) in revenue for FY 2023, a 13% increase year-over-year.

Subscribers: Premium subscribers reached 236 million, accounting for most of its revenue.

Ad-Supported Growth: The ad-supported tier reached 389 million users, growing faster than premium.

Profitability: Spotify achieved its first quarterly operating profit of €32 million in Q4 2023, a positive signal for investors.

These numbers show that Spotify has reached a scale where profitability is increasingly realistic, a critical driver for stock forecasts.

Several factors influence whether Spotify stock is expected to rise in the near and long term:

Spotify’s consistent expansion in global markets—especially in India, Southeast Asia, and Latin America—adds new streams of growth. While North America and Europe are more saturated, emerging markets show double-digit user growth.

Spotify has been investing in podcasts, audiobooks, and AI-driven personalization. Its acquisition of Anchor, Megaphone, and other audio platforms signals a strategy to become a one-stop shop for all audio. Podcasts alone contribute over $500 million annually, and analysts expect this to double by 2026.

Spotify has shifted focus from hyper-growth to operational efficiency, cutting 17% of its workforce in late 2023. This reduced costs and sent a positive signal to investors that management is serious about margin improvements.

Spotify faces strong competition from Apple Music, Amazon Music, and YouTube Music. However, Spotify retains the largest global market share at 31% (IFPI 2024 report), giving it a strong advantage.

Spotify’s AI DJ feature, launched in 2023, has increased engagement and retention. By keeping users on the platform longer, Spotify improves both ad revenue and subscriber stickiness.

According to data from TipRanks and Yahoo Finance (early 2025):

Median Price Target: $280 per share

Current Price (Feb 2025): ~$250 per share

Upside Potential: ~12% over the next 12 months

Most analysts rate Spotify as a “Buy”, citing improving margins and revenue diversification.

If Spotify continues double-digit growth in subscribers and monetizes podcasts and audiobooks more effectively, analysts forecast the stock could trade between $300 and $350 within 2–3 years.

Long-term projections are highly speculative, but Spotify’s ability to dominate the global audio market could push its valuation significantly higher. If it maintains leadership while turning consistent profits, some analysts believe Spotify stock could double by 2030.

No stock forecast is complete without recognizing the risks:

High Competition – Apple and Amazon can afford to operate music streaming at a loss to support their ecosystems. Spotify doesn’t have that luxury.

Royalty Costs – Around 70% of Spotify’s revenue goes to record labels and publishers, limiting margin potential.

Ad Market Volatility – Ad-supported revenue can drop during recessions, as seen in 2020.

Regulatory Risks – Ongoing disputes with Apple regarding App Store fees could impact growth.

Dependence on Premium Growth – If subscriber growth slows, revenue projections may miss targets.

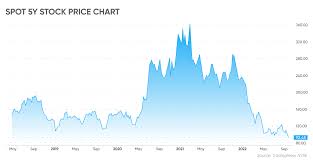

Since its direct listing in April 2018, Spotify stock has shown volatility:

2018 IPO Price: $165

All-Time High: ~$387 (Feb 2021, during pandemic streaming boom)

All-Time Low: ~$69 (Nov 2022, during tech stock downturn)

Current Price (Feb 2025): ~$250

This roller-coaster highlights both risk and potential. Investors who bought during lows in 2022 have already seen significant returns.

Q: Is Spotify stock a good buy right now?

A: Many analysts currently rate Spotify as a “Buy” due to improved profitability and user growth, though risks remain.

Q: Does Spotify pay dividends?

A: No, Spotify does not pay dividends. It reinvests profits into growth and innovation.

Q: What is the biggest challenge for Spotify’s stock forecast?

A: The biggest challenge is royalty costs, which keep profit margins thin compared to other tech companies.

Q: Can Spotify become profitable long-term?

A: Yes, with operational cost reductions and growth in podcasts and ads, analysts believe consistent profitability is achievable by 2025–2026.

The Spotify stock forecast suggests cautious optimism. With growing revenue, improved efficiency, and diversification into podcasts and audiobooks, Spotify has positioned itself for future growth. Short-term forecasts predict modest gains, while long-term projections suggest significant upside if Spotify maintains its market leadership and achieves sustainable profitability.

However, investors should balance optimism with awareness of risks like competition and royalty costs. For those who believe in the future of streaming and Spotify’s dominance, SPOT stock could remain a strong growth play in the coming years.