AutoArk Pre-A funding success marks a significant milestone in the mul...... [more]

The technical foundation of OpenAI Aura represents a masterful integration of proven web technologies with cutting-edge AI capabilities. Built on the Chromium engine, the browser maintains compatibility with existing web standards while introducing revolutionary AI-powered features.

| Component | Traditional Browser | OpenAI Aura |

|---|---|---|

| Content Processing | Static HTML Rendering | AI-Enhanced Dynamic Analysis |

| Search Integration | Basic Query Submission | Contextual Intent Recognition |

| User Assistance | Limited Help Documentation | Real-time AI Guidance |

| Language Support | Basic Translation Tools | Advanced NLP Processing |

The OpenAI browser Aura development team has implemented a sophisticated architecture that processes web content through multiple AI layers, ensuring both performance and intelligence without compromising browsing speed ???♂?.

The introduction of OpenAI Aura is set to dramatically improve digital productivity across various user segments. Students can benefit from intelligent research assistance, professionals can streamline their workflow with AI-powered content analysis, and casual users can enjoy a more intuitive browsing experience ??.

Early beta testing of the OpenAI browser Aura development has shown remarkable improvements in task completion times, with users reporting up to 40% faster information gathering and processing. The AI's ability to understand context and provide relevant suggestions has transformed routine browsing into an interactive, productive experience ??.

The OpenAI browser Aura development represents more than just a technological advancement – it signals a fundamental shift in how we interact with digital information. As AI becomes increasingly integrated into everyday tools, browsers like OpenAI Aura are setting new standards for user experience and functionality.

Industry experts predict that this development will influence other major browser developers to accelerate their own AI integration efforts, potentially leading to a new era of intelligent web browsing. The success of OpenAI Aura could establish new benchmarks for browser performance, user assistance, and content interaction ??.

The OpenAI browser Aura development represents a pivotal moment in web browsing evolution, combining the reliability of Chromium with the intelligence of advanced AI systems. As this technology continues to develop, users can expect increasingly sophisticated features that make web browsing more efficient, intuitive, and productive. The integration of OpenAI Aura into daily browsing routines promises to transform how we consume, process, and interact with online information, setting new standards for what users can expect from their web browsing experience.

The tech world is buzzing with excitement as OpenAI browser Aura devel...... [more]

Amazon Web Services has officially launched Kiro AI, a groundbreaking...... [more]

So what could actually pop this AI bubble? Apollo economists have identified several potential trigger points that could send AI stocks tumbling faster than you can say 'ChatGPT'. ??

First up is the earnings reality check. At some point, these AI companies need to actually make money that justifies their sky-high valuations. When quarterly reports start showing that AI revenue isn't matching the hype, investors might finally wake up from their AI-induced trance. The gap between projected AI revenues and actual delivered results continues to widen, with many companies struggling to monetise their AI capabilities effectively.

Then there's the regulatory hammer that could drop at any moment. Governments worldwide are getting increasingly nervous about AI's power and potential risks. New regulations could significantly impact AI companies' growth prospects and profitability, potentially triggering a massive sell-off. The European Union's AI Act and similar legislation in other jurisdictions represent existential threats to current AI business models.

Interest rates are another wild card. If central banks decide to raise rates to combat inflation, high-growth AI stocks (which are particularly sensitive to interest rate changes) could see their valuations crushed overnight. It's basic finance – when borrowing costs go up, speculative investments become less attractive. ??

Technical limitations could also serve as a catalyst for market correction. Despite the hype, current AI technology still faces significant constraints in terms of accuracy, reliability, and scalability. If these limitations become more apparent to investors, it could trigger a reassessment of AI companies' long-term prospects and lead to widespread selling pressure.

Competition from unexpected sources presents another risk factor. As AI technology becomes more commoditised, traditional technology companies and even startups could disrupt established AI players, potentially causing dramatic shifts in market leadership and valuations.

Look, I'm not saying you should panic sell all your AI stocks tomorrow. But the Apollo economists AI bubble warning is serious enough that you should probably start thinking about risk management. Here's what smart money is doing right now. ??

Diversification is your best friend in times like these. If your portfolio is heavily weighted toward AI stocks, it might be time to rebalance. Consider spreading your risk across different sectors, geographies, and asset classes. Don't put all your eggs in the AI basket, no matter how shiny that basket looks. Professional portfolio managers recommend limiting AI exposure to no more than 15-20% of total portfolio value, even for aggressive growth investors.

Position sizing is crucial too. Even if you believe in AI's long-term potential (which you probably should), that doesn't mean you should bet your entire financial future on it. Keep your AI exposure to a level where you can sleep at night, even if these stocks drop 50% or more. The volatility in AI stocks has already demonstrated the potential for dramatic price swings, with some securities experiencing 30% daily movements.

Consider some defensive plays as well. Value stocks, dividend-paying companies, and even some cash positions might look boring compared to AI rockets, but they'll be your lifeline if this bubble pops as dramatically as Apollo economists are predicting. ??

Hedging strategies deserve serious consideration for investors with significant AI exposure. Options strategies, inverse ETFs, or even traditional safe-haven assets like gold could provide portfolio insurance against a potential AI market crash. The cost of hedging may seem expensive now, but it's considerably cheaper than losing 70-80% of your investment value during a bubble burst.

Dollar-cost averaging represents another defensive strategy worth considering. Instead of making large lump-sum investments in AI stocks, spreading purchases over time can help reduce the impact of volatility and potentially lower your average cost basis. This approach has historically proven effective during periods of market uncertainty and elevated volatility.

Here's the thing that makes this whole AI bubble situation so tricky – AI probably will transform the world, just maybe not as quickly as current stock prices suggest. Apollo's economists aren't saying AI is worthless; they're saying the timeline and expectations are completely out of whack with reality. ??

Think about it this way: the internet eventually did revolutionise everything, but it took decades, not months. Most of the companies that were hot during the dot-com bubble either went bankrupt or became irrelevant. The real winners were often companies that came later or adapted better to the new reality. Amazon survived the dot-com crash and eventually became one of the world's most valuable companies, but it took nearly two decades to reach that point.

The same thing will probably happen with AI. Some of today's AI darlings will survive and thrive, but many will crash and burn. The challenge is figuring out which is which before the market does it for you, often in the most painful way possible. ??

Historical analysis of technology adoption cycles suggests that transformative technologies typically require 15-25 years to reach full market penetration and generate the returns that early investors anticipate. The gap between technological capability and practical implementation often proves much wider than initial projections suggest, leading to disappointment among investors who expect immediate returns.

Current AI technology, while impressive, still faces significant hurdles in terms of reliability, cost-effectiveness, and scalability. Many AI applications remain in the experimental or pilot phase, with limited evidence of sustainable competitive advantages or defensible market positions. This disconnect between current capabilities and market valuations represents a fundamental risk that Apollo economists have identified.

The Apollo economists AI bubble warning isn't just doom and gloom – it's actually a roadmap for smarter investing. When institutional investors with this much skin in the game start sounding alarms, retail investors should definitely pay attention. ??

Consider adopting a more cautious approach to AI investments. Instead of chasing the hottest AI stocks, look for companies with solid fundamentals that happen to benefit from AI trends. Think established tech companies with diverse revenue streams rather than pure-play AI startups with no profits. Companies like Microsoft, Google, and Apple have AI capabilities but also maintain substantial revenue from traditional business lines, providing downside protection during market corrections.

Timing your entries and exits becomes even more critical in bubble conditions. Dollar-cost averaging might be your friend here – instead of making large lump-sum investments in AI stocks, consider spreading your purchases over time to reduce the impact of volatility. This strategy has historically proven effective during periods of market uncertainty and can help investors avoid the psychological trap of buying at market peaks.

Focus on companies with demonstrable AI revenue streams rather than those making promises about future AI capabilities. Revenue quality matters more than revenue growth when markets become more discriminating, which typically happens during the later stages of bubble cycles. Companies that can show consistent, profitable AI-related revenue streams are more likely to survive market corrections.

Consider the broader ecosystem rather than just direct AI plays. Companies that provide infrastructure, data, or services to AI companies may offer more stable investment opportunities with less volatility than pure-play AI stocks. These 'picks and shovels' investments often perform better during market downturns while still providing exposure to AI growth trends.

The potential consequences of an AI bubble burst extend far beyond individual investor portfolios. Apollo economists have highlighted several macroeconomic risks that could emerge if AI valuations collapse suddenly and dramatically. ??

Pension funds and institutional investors have allocated significant portions of their portfolios to AI-related investments, meaning that a market crash could impact retirement security for millions of people. The interconnected nature of modern financial markets means that AI stock losses could cascade through the broader economy, potentially triggering recession-like conditions.

Employment implications represent another critical concern. Many companies have made substantial investments in AI infrastructure and personnel based on projected returns that may not materialise. If AI investments fail to generate expected returns, corporate restructuring and layoffs could follow, particularly in technology sectors.

The venture capital ecosystem could face severe disruption if AI valuations collapse. Many VC funds have concentrated their investments in AI startups, and a market correction could limit their ability to raise future funds or support existing portfolio companies. This could create a funding winter for innovative AI research and development.

International competitiveness concerns also factor into the equation. Countries that have made substantial public investments in AI development could face political and economic pressure if those investments fail to generate expected returns. This could impact government funding for AI research and development programmes globally.

The bottom line is that Apollo's economists are giving us a heads-up that could save our portfolios from serious damage. The AI bubble might continue inflating for months or even years, but when it pops, the aftermath could make the dot-com crash look like a minor correction. Smart investors will heed these warnings and position themselves accordingly, balancing AI opportunity with realistic risk management. Remember, it's not about timing the market perfectly – it's about not getting completely wiped out when reality finally catches up with speculation. ??

The key takeaway from the Apollo economists AI bubble warning is that preparation and diversification remain the best defence against market volatility. While AI technology will undoubtedly continue to evolve and create value, the current disconnect between market valuations and fundamental business metrics suggests that a significant correction may be inevitable. Investors who acknowledge this risk and adjust their strategies accordingly will be better positioned to weather the storm and capitalise on opportunities that emerge from market dislocations.

The financial world is buzzing with warnings from Apollo economists AI...... [more]

1. Scale AI Implements 14% Workforce Reduction with CEO TransitionData...... [more]

Imagine waking up to freshly brewed coffee, clean floors, and organize...... [more]

Imagine finishing hours of work only to watch your AI assistant freeze...... [more]

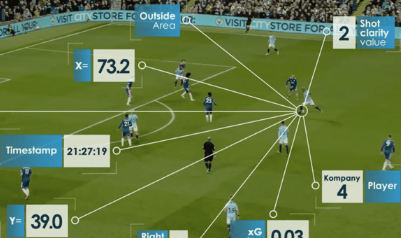

Professional sports teams invest millions in player salaries yet strug...... [more]

Game developers struggle to create memorable non-player characters tha...... [more]

In today's AI-driven world, service interruptions can have catastr...... [more]

Game developers spend months brainstorming concepts, only to discover...... [more]

Are you confronting the escalating challenges in carbon credit markets...... [more]

Introduction:Creating music videos used to require expensive cameras,...... [more]

Imagine typing a simple text prompt and watching it transform into a c...... [more]

As artificial intelligence reshapes industries worldwide, one question...... [more]

The Frustration of AI Service InterruptionsYou're in the middle of...... [more]

A Perplexity AI internship isn’t just a line on your resume — it’s a p...... [more]

Dreaming of joining the future of AI research and development? The Per...... [more]

Launching your career in AI starts with the right experience. A Perple...... [more]

You're mid-conversation with an AI assistant when suddenly—the cha...... [more]