Investment decisions have become increasingly complex as financial markets evolve at unprecedented speeds. Individual investors struggle to analyze vast amounts of market data, identify profitable opportunities, and manage risk effectively without professional expertise. Traditional investment advisory services remain expensive and often inaccessible to average investors. Revolutionary ai tools have transformed investment management by providing sophisticated analysis, automated portfolio optimization, and real-time market insights previously available only to institutional investors. This comprehensive guide examines five leading platforms that are democratizing professional-grade investment strategies.

Why AI Tools Are Essential for Modern Investment Success

Financial markets generate terabytes of data daily from price movements, economic indicators, corporate earnings, and global events. Human investors cannot process this information efficiently or identify subtle patterns that drive market behavior. AI tools excel at analyzing complex datasets, recognizing market trends, and executing investment strategies with precision and speed impossible for manual approaches.

Modern investors face unique challenges including market volatility, information overload, emotional decision-making, and time constraints. AI tools address these obstacles by providing objective analysis, removing emotional bias from investment decisions, and continuously monitoring market conditions to optimize portfolio performance.

Top 5 AI Tools for Investment Excellence

1. Betterment - Intelligent Portfolio Automation

Betterment pioneered automated investment management through sophisticated ai tools that create and maintain diversified portfolios based on individual risk tolerance and financial goals. This platform combines Nobel Prize-winning investment theories with advanced machine learning algorithms.

Advanced Investment Features:

Goal-based investment planning with timeline optimization

Tax-loss harvesting automation maximizing after-tax returns

Dynamic rebalancing maintaining optimal asset allocation

Socially responsible investing options with ESG screening

Retirement planning integration with 401(k) coordination

The platform's algorithms continuously analyze market conditions, economic indicators, and individual portfolio performance to make automatic adjustments. Users benefit from institutional-quality investment management without minimum balance requirements or complex fee structures.

2. Wealthfront - Comprehensive Financial Planning

Wealthfront leverages cutting-edge ai tools to provide holistic financial planning services that extend beyond basic portfolio management. This platform specializes in optimizing entire financial ecosystems including investments, banking, and financial planning.

Sophisticated Capabilities:

Path financial planning projecting long-term wealth accumulation

Direct indexing for tax optimization and customization

Stock-level tax-loss harvesting for enhanced returns

Cash management with high-yield savings integration

College planning with 529 account optimization

The system's machine learning models analyze thousands of financial scenarios to recommend optimal strategies for achieving specific financial objectives. Advanced tax optimization features can increase after-tax returns by 1-2% annually through intelligent harvesting strategies.

3. Robo-Advisor by Charles Schwab - Institutional-Grade Analysis

Charles Schwab's ai tools platform combines decades of investment expertise with artificial intelligence to deliver institutional-quality portfolio management for individual investors. This system provides access to professional investment strategies typically reserved for high-net-worth clients.

Professional Investment Tools:

Multi-factor portfolio construction using academic research

Alternative investment integration including REITs and commodities

Tactical asset allocation responding to market conditions

Risk parity strategies for enhanced diversification

Professional financial advisor access for complex situations

The platform's algorithms incorporate macroeconomic analysis, sector rotation strategies, and risk management techniques used by professional money managers. Users receive detailed performance attribution analysis explaining portfolio returns and risk characteristics.

4. Acorns - Micro-Investment Automation

Acorns revolutionizes investment accessibility through ai tools that automate micro-investing from everyday purchases. This platform makes investing effortless by analyzing spending patterns and automatically investing spare change from transactions.

Innovative Investment Approach:

Round-up investing from linked debit and credit cards

Recurring investment automation with smart timing

Found Money cashback investing from partner retailers

Educational content personalized to investment experience

Social impact investing options supporting causes

The system's artificial intelligence optimizes investment timing based on market conditions and personal cash flow patterns. Behavioral analysis helps users develop consistent investing habits while minimizing the psychological barriers to getting started.

5. Personal Capital - Wealth Management Integration

Personal Capital employs advanced ai tools to provide comprehensive wealth management services that integrate investment management with financial planning and analysis. This platform excels at managing complex financial situations for high-net-worth individuals.

Comprehensive Wealth Features:

Net worth tracking across all financial accounts

Investment fee analysis identifying cost optimization opportunities

Retirement planning with Monte Carlo simulations

Tax optimization strategies for complex situations

Estate planning integration with professional advisors

The platform's algorithms analyze entire financial pictures to identify optimization opportunities across investments, taxes, insurance, and estate planning. Advanced analytics provide insights into portfolio performance, risk exposure, and progress toward financial goals.

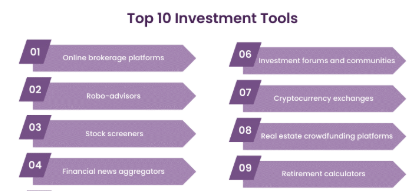

AI Tools Investment Performance Comparison

| Platform | Minimum Investment | Annual Fee | Investment Focus | Best For |

|---|---|---|---|---|

| Betterment | $0 | 0.25%-0.40% | Goal-based investing | Beginner investors |

| Wealthfront | $500 | 0.25% | Tax optimization | Tax-conscious investors |

| Schwab Robo | $5,000 | 0.30% | Professional strategies | Sophisticated investors |

| Acorns | $0 | $1-5/month | Micro-investing | New investors |

| Personal Capital | $100,000 | 0.49%-0.89% | Wealth management | High-net-worth clients |

Maximizing Returns with AI Tools Investment Strategies

Successful implementation of ai tools for investment management requires understanding each platform's strengths and aligning them with personal financial objectives. Long-term investors benefit most from automated rebalancing and tax optimization features, while active traders may prefer platforms offering more frequent portfolio adjustments.

Risk management becomes crucial when using ai tools for investment decisions. These platforms excel at diversification and systematic risk control but cannot eliminate market risk entirely. Users should maintain realistic expectations and understand that artificial intelligence enhances rather than guarantees investment performance.

Advanced Features of Modern AI Tools

Contemporary ai tools incorporate sophisticated techniques including natural language processing for news analysis, sentiment analysis for market timing, and reinforcement learning for strategy optimization. These technologies enable more nuanced investment decisions based on comprehensive market analysis.

Machine learning algorithms continuously improve performance by analyzing historical outcomes and refining investment strategies. This adaptive capability allows ai tools to evolve with changing market conditions and incorporate new data sources for enhanced decision-making.

Future Evolution of AI Tools in Investment Management

The investment industry anticipates significant advancements in ai tools capabilities including real-time alternative data integration, cryptocurrency portfolio management, and personalized ESG investing strategies. Advanced natural language processing will enable more sophisticated analysis of earnings calls, regulatory filings, and market commentary.

Emerging ai tools will likely incorporate behavioral finance principles more deeply, helping investors overcome cognitive biases that impair investment performance. Integration with financial planning software will provide more comprehensive wealth management solutions.

Frequently Asked Questions

Q: How do AI tools compare to human financial advisors in investment performance?A: AI tools typically match or exceed human advisor performance while offering lower fees, though human advisors provide personalized guidance for complex financial situations.

Q: Are AI tools safe for managing investment portfolios?A: Reputable AI tools employ institutional-grade security measures and are regulated by financial authorities, making them as safe as traditional investment platforms.

Q: Can AI tools adapt to changing market conditions effectively?A: Modern AI tools continuously learn from market data and adjust strategies automatically, often responding to market changes faster than human managers.

Q: What level of investment knowledge is required to use AI tools successfully?A: Most AI tools are designed for beginners and require minimal investment knowledge, though understanding basic financial concepts improves outcomes.

Q: How do AI tools handle market crashes and extreme volatility?A: AI tools employ sophisticated risk management techniques including diversification, rebalancing, and defensive positioning during market stress periods.