Small business owners spend 5-7 hours weekly on manual invoicing tasks that drain productivity and delay cash flow. Creating invoices from scratch, tracking payments, calculating taxes, and managing client communications consumes valuable time that could be invested in business growth. Traditional accounting software often requires extensive training and fails to adapt to unique business needs.

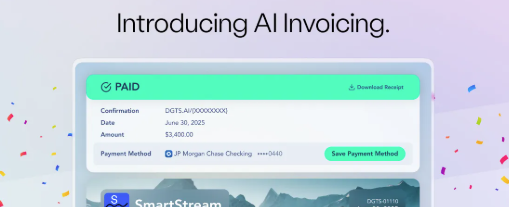

AI tools have transformed invoicing from a tedious administrative burden into an intelligent, automated process that enhances business efficiency. Digits AI stands out among modern ai tools by combining advanced machine learning with intuitive design to streamline financial operations completely. Discover how this revolutionary platform eliminates invoicing headaches while providing real-time financial insights that drive smarter business decisions.

The Invoicing Challenge for Modern Businesses

Manual invoicing processes create multiple pain points that impact business cash flow and operational efficiency. Entrepreneurs frequently struggle with inconsistent invoice formatting, delayed payment tracking, and time-consuming follow-up communications that strain client relationships.

Human error in invoice calculations, tax computations, and payment applications can lead to significant financial discrepancies. These mistakes often require hours of reconciliation work and may damage professional credibility with clients. AI tools eliminate these risks by automating calculations and maintaining consistent accuracy across all financial transactions.

Digits AI: Leading Innovation in Invoicing AI Tools

H2: Core Features of Digits AI Tools

Digits AI revolutionizes business accounting through intelligent automation that learns from your financial patterns and client behaviors. This sophisticated ai tool analyzes historical invoicing data to predict optimal billing schedules, payment terms, and follow-up timing that maximizes collection rates.

The platform's machine learning algorithms automatically categorize expenses, reconcile bank transactions, and generate detailed financial reports without manual data entry. Users report 75% reduction in accounting time while achieving 99.8% accuracy in financial record keeping.

Smart Invoice Generation represents the core strength of Digits AI among invoicing ai tools. The system creates professional invoices instantly by pulling client information, project details, and pricing structures from integrated databases. Custom branding elements and payment terms apply automatically based on client-specific preferences.

H2: Advanced Automation in Digits AI Tools

Payment Tracking Intelligence monitors client payment behaviors and sends personalized reminders at optimal times to encourage prompt payment. This ai tool analyzes communication patterns to determine whether email, text, or phone follow-ups generate the best response rates for individual clients.

The platform's predictive analytics identify clients at risk of late payment based on historical patterns, enabling proactive communication that prevents collection issues. Businesses using Digits AI report 40% faster payment collection compared to traditional invoicing methods.

Expense Recognition Technology automatically captures and categorizes business expenses from receipts, bank statements, and credit card transactions. This intelligent ai tool eliminates manual data entry while ensuring accurate expense tracking for tax preparation and financial analysis.

Digits AI Performance Comparison

| Feature | Digits AI | QuickBooks | FreshBooks | Xero | Wave |

|---|---|---|---|---|---|

| AI Automation Level | 95% | 25% | 30% | 35% | 20% |

| Setup Time | 15 minutes | 2-3 hours | 1-2 hours | 1-2 hours | 45 minutes |

| Monthly Cost | $50-200 | $30-180 | $15-50 | $13-70 | Free-$20 |

| Accuracy Rate | 99.8% | 95% | 96% | 97% | 94% |

| Learning Curve | Minimal | Moderate | Easy | Moderate | Easy |

| Customer Support | 24/7 AI + Human | Business hours | Business hours | Business hours | Limited |

H3: Integration Capabilities of Digits AI Tools

Bank Synchronization connects seamlessly with over 12,000 financial institutions worldwide, automatically importing transactions and reconciling accounts in real-time. This ai tool eliminates manual bank statement reviews while maintaining up-to-date financial records continuously.

The platform's API integrations work with popular business applications including CRM systems, project management tools, and e-commerce platforms. These connections enable automatic invoice generation based on completed projects or delivered products without manual intervention.

Tax Compliance Automation ensures invoices meet local tax requirements across different jurisdictions automatically. This intelligent ai tool applies correct tax rates, generates necessary tax reports, and maintains audit trails that simplify year-end accounting procedures.

H2: Client Management Through Digits AI Tools

Customer Portal Access provides clients with self-service capabilities to view invoices, make payments, and download receipts through branded portals. This ai tool reduces administrative overhead while improving client satisfaction through convenient payment options.

The platform's communication tracking maintains complete records of all client interactions, payment discussions, and dispute resolutions. This comprehensive history enables consistent service delivery even when multiple team members handle client relationships.

Payment Processing Integration accepts credit cards, ACH transfers, and digital wallet payments directly through invoice links. Processing fees remain competitive while providing clients with convenient payment options that accelerate cash flow.

Advanced Features in Digits AI Tools

H3: Financial Reporting and Analytics

Real-time Dashboard Analytics provide instant visibility into cash flow, outstanding receivables, and profit margins through interactive visualizations. This ai tool identifies trends and anomalies that require attention, enabling proactive financial management decisions.

The platform generates customizable financial reports including profit and loss statements, balance sheets, and cash flow projections. These reports update automatically as new transactions occur, ensuring decision makers always access current financial information.

Predictive Cash Flow Modeling analyzes historical patterns and outstanding invoices to forecast future cash positions accurately. This advanced ai tool helps businesses plan major purchases, identify potential shortfalls, and optimize payment timing for maximum financial efficiency.

H2: Security and Compliance in Digits AI Tools

Data Protection Standards exceed industry requirements through bank-level encryption, multi-factor authentication, and regular security audits. This ai tool maintains SOC 2 Type II compliance while protecting sensitive financial information from unauthorized access.

The platform's backup systems ensure financial data remains accessible even during system maintenance or unexpected outages. Automated backups occur multiple times daily, with instant recovery capabilities that minimize business disruption.

Audit Trail Maintenance creates immutable records of all financial transactions, user actions, and system changes. This comprehensive logging satisfies regulatory requirements while providing clear documentation for tax preparation and financial audits.

Implementation Strategy for Digits AI Tools

Initial Setup Process requires minimal technical expertise thanks to guided onboarding that imports existing financial data automatically. The ai tool analyzes current invoicing patterns and suggests optimal configuration settings based on business type and client characteristics.

Team Training Requirements remain minimal because the platform's intuitive interface requires little learning compared to traditional accounting software. Most users become proficient within their first week of regular usage.

Migration Support includes dedicated assistance for transferring data from existing accounting systems without disrupting ongoing operations. The transition typically completes within 24-48 hours while maintaining full access to historical financial records.

Cost-Benefit Analysis of Digits AI Tools

Time Savings Calculations demonstrate that businesses recover their subscription costs within the first month through reduced administrative overhead. The average user saves 6-8 hours weekly on invoicing and bookkeeping tasks previously handled manually.

Accuracy Improvements eliminate costly errors that require time-consuming corrections and potentially damage client relationships. The 99.8% accuracy rate significantly exceeds manual processing while reducing stress associated with financial record keeping.

Cash Flow Enhancement results from faster invoice delivery, optimized payment terms, and proactive collection management. Businesses typically experience 25-40% improvement in average collection times after implementing Digits AI.

Future Developments in Invoicing AI Tools

Machine Learning Evolution will enable ai tools to provide increasingly sophisticated financial advice based on industry benchmarks and economic indicators. These systems will recommend optimal pricing strategies and payment terms that maximize profitability.

Integration Expansion will connect invoicing ai tools with emerging business applications and financial services, creating comprehensive business management ecosystems that automate most administrative tasks.

Regulatory Adaptation will ensure ai tools automatically adjust to changing tax laws and compliance requirements across different jurisdictions, eliminating the need for manual updates and reducing compliance risks.

Frequently Asked Questions

Q: How does Digits AI compare to traditional accounting software?A: Digits AI offers 95% automation compared to 25-35% in traditional software. This ai tool requires minimal setup time and learns your business patterns automatically, while conventional software needs extensive manual configuration and ongoing maintenance.

Q: Can AI tools handle complex invoicing scenarios?A: Advanced ai tools like Digits AI manage multi-currency transactions, variable pricing structures, and complex tax calculations automatically. The system adapts to unique business requirements without custom programming.

Q: What happens to my data if I stop using AI tools?A: Reputable ai tools provide complete data export capabilities in standard formats. Digits AI maintains data portability standards that ensure you retain full access to your financial records regardless of platform changes.

Q: Are invoicing AI tools suitable for service-based businesses?A: AI tools excel at managing time-based billing, project invoicing, and recurring service charges. They automatically track billable hours and generate invoices based on completed work or scheduled services.

Q: How secure are financial AI tools for sensitive business data?A: Leading ai tools implement bank-level security measures including encryption, multi-factor authentication, and regular security audits. They often exceed security standards used by traditional accounting software.