In the dynamic landscape of cryptocurrency markets, arbitrage trading has consistently remained a lucrative strategy for savvy traders. With the rapid advancement of artificial intelligence technology, an increasing number of traders are turning to AI tools to automate their arbitrage processes, enhance efficiency, and capture fleeting market opportunities. This comprehensive guide explores how AI tools are fundamentally transforming the crypto arbitrage trading ecosystem and examines the most effective AI arbitrage solutions currently available.

Understanding AI Tools in Cryptocurrency Arbitrage Trading

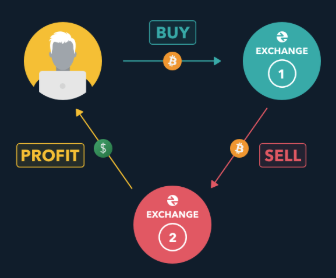

Cryptocurrency arbitrage involves capitalizing on price discrepancies between different exchanges or trading pairs to generate risk-free profits. AI tools leverage sophisticated algorithms and machine learning technologies to automatically identify, analyze, and execute these arbitrage opportunities with unprecedented precision.

Traditional arbitrage trading requires traders to continuously monitor price fluctuations across multiple platforms—a process that is not only time-consuming but often results in missed opportunities. In contrast, AI tools can simultaneously monitor dozens or even hundreds of exchanges, identifying price differentials and executing trades within milliseconds—an efficiency level that human operators simply cannot match.

How AI Tools Are Transforming Arbitrage Trading Paradigms

The core advantages of AI arbitrage tools lie in their data processing capabilities and execution speed. These sophisticated tools can:

Analyze price data across multiple trading platforms in real-time

Automatically identify profitable arbitrage opportunities

Calculate net profitability after accounting for transaction fees and transfer times

Execute buy and sell operations at optimal moments

Continuously learn and refine trading strategies for improved performance

Compared to conventional trading bots, AI-powered arbitrage tools demonstrate superior adaptability by continuously optimizing their algorithms in response to market changes, enabling them to excel in the highly volatile cryptocurrency markets.

Premier AI Tools for Cryptocurrency Arbitrage Trading

Bitsgap - Comprehensive AI Arbitrage Solution

Bitsgap stands as one of the most comprehensive AI arbitrage tools available, offering not only traditional arbitrage functionality but also integrating advanced AI algorithms to predict market movements with remarkable accuracy.

Core Capabilities:

Connectivity with over 25 major cryptocurrency exchanges

Real-time monitoring of more than 10,000 trading pairs

Intelligent risk management system

Automated arbitrage execution

AI-driven market trend analysis

What distinguishes Bitsgap is its "Smart Arbitrage" feature, which employs machine learning algorithms to analyze historical price data and predict the time periods and trading pairs most likely to present arbitrage opportunities, thereby enhancing success rates. User feedback indicates that Bitsgap's AI prediction functionality can increase arbitrage success rates by over 20% during periods of high market volatility.

Cryptohopper - AI-Powered High-Frequency Arbitrage Tool

Cryptohopper specializes in high-frequency trading strategies, utilizing AI technology to execute multiple small-volume arbitrage trades within extremely short timeframes.

Distinctive Features:

Cloud-hosted platform ensuring 24/7 uninterrupted operation

Advanced signal provider system

Adaptive AI algorithms that adjust strategies based on market conditions

Community strategy marketplace allowing subscription to professional traders' AI strategies

Detailed performance analytics and reporting tools

Cryptohopper's AI engine excels particularly in identifying flash arbitrage opportunities—price differentials that exist for mere seconds. Its unique "Arbitrage Radar" feature continuously scans all supported exchanges and immediately triggers trade execution upon discovering arbitrage opportunities. According to user data, Cryptohopper's AI arbitrage tools identify and execute an average of 30-50 profitable arbitrage trades daily during periods of market volatility.

TradeSanta - User-Friendly AI Arbitrage Automation Platform

For newcomers to arbitrage trading, TradeSanta offers a more accessible AI arbitrage solution that can be utilized without extensive technical knowledge.

Key Advantages:

Intuitive user interface ideal for beginners

Pre-configured AI arbitrage strategy templates

Real-time arbitrage opportunity alerts

Multi-tiered risk management system

Detailed trading logs and performance analytics

TradeSanta's "AI Arbitrage Assistant" feature deserves particular mention, as it analyzes users' trading history and risk preferences before recommending the most suitable arbitrage strategies. This personalized AI guidance enables even novice traders to participate in arbitrage trading with relative safety. Platform data reveals that users employing the AI Assistant feature achieve average returns 15% higher than those manually configuring strategies.

Gimmer - Professional-Grade AI Arbitrage Platform

Gimmer caters to experienced traders by offering more sophisticated and customizable AI arbitrage tools.

Core Functionalities:

Highly customizable AI algorithms

Support for triangular arbitrage and cross-exchange arbitrage

Advanced backtesting tools for evaluating AI strategies against historical data

Deep learning models that continuously optimize arbitrage strategies

API connectivity for integration with other trading tools

Gimmer's "AI Strategy Builder" allows users to create their own AI arbitrage algorithms with specific parameters and conditions. This flexibility enables professional traders to develop unique arbitrage strategies aligned with their trading philosophies. Platform data indicates that advanced users utilizing customized AI strategies achieve average monthly returns of 3-5%, significantly outperforming users employing standard strategies.

How AI Tools Optimize Critical Factors in Cryptocurrency Arbitrage Trading

Speed Optimization - Millisecond-Level Decision Making

In arbitrage trading, speed is paramount. A primary advantage of AI tools is their ability to analyze data and execute trades within milliseconds.

Modern AI arbitrage tools employ high-performance computing architectures and optimized algorithms capable of executing trades immediately upon identifying arbitrage opportunities. For instance, Bitsgap's AI engine maintains an average response time below 100 milliseconds, meaning the entire process from identifying price differentials to executing trades requires less than 0.1 seconds.

This ultra-high-speed execution capability enables AI tools to capture ephemeral arbitrage windows that would be impossible for human traders to exploit, particularly in highly volatile markets.

Risk Management - AI-Driven Secure Trading

While arbitrage trading is theoretically risk-free, practical implementation involves various risks including slippage, fluctuating transaction fees, and liquidity challenges. AI tools substantially mitigate these risks through intelligent risk management systems.

AI Risk Management Capabilities Include:

Real-time slippage prediction and adjustment

Dynamic fee calculation and profitability analysis

Liquidity assessment and trade size optimization

Intelligent stop-loss mechanisms

Anomalous market condition detection

For example, TradeSanta's AI risk management system evaluates current market depth before executing each trade, predicts potential slippage, and adjusts trade volume accordingly to ensure executed trades remain profitable. Data shows that traders utilizing AI risk management experience over 40% lower loss rates compared to those who don't.

Multi-Strategy Integration - AI's Adaptive Flexibility

Market conditions constantly evolve, making it difficult for any single arbitrage strategy to maintain profitability across all market environments. Advanced AI arbitrage tools can simultaneously operate and evaluate multiple arbitrage strategies, automatically switching to the optimal strategy based on current market conditions.

Common AI Arbitrage Strategies Include:

Simple cross-exchange arbitrage

Triangular arbitrage (leveraging price differentials between three different trading pairs)

Statistical arbitrage (based on deviations from historical price relationships)

Latency arbitrage (exploiting delays in price updates between exchanges)

Funding rate arbitrage (in perpetual contract markets)

Cryptohopper's "AI Strategy Rotator" feature continuously evaluates the performance of different arbitrage strategies and automatically allocates funds to the best-performing strategies based on real-time market data. Users report that traders utilizing this feature earn an average of 25% more profit than those adhering to a single strategy.

Selecting the Optimal AI Arbitrage Tool for Your Requirements

Choosing Appropriate AI Tools Based on Experience Level

Different AI arbitrage tools cater to users with varying levels of experience. Beginners should prioritize user-friendly platforms with pre-configured strategies, while experienced traders may require more highly customizable tools.

Recommendations for Beginners:

TradeSanta: Simple intuitive interface with pre-configured AI strategies

KuCoin Trading Bot: Exchange-integrated platform with easily accessible AI arbitrage features

3Commas: Provides detailed tutorials and straightforward AI arbitrage setup

Recommendations for Advanced Users:

Gimmer: Highly customizable AI algorithms

Cryptohopper: Advanced AI signal systems and strategy development tools

Bitsgap: Comprehensive arbitrage toolkit and in-depth market analysis

Beginners should start with modest capital, gradually familiarizing themselves with the AI tool's functionalities and performance before increasing investment scale. Advanced users can leverage these tools' API capabilities to integrate AI arbitrage strategies into broader trading systems.

Evaluating Key Performance Metrics for AI Tools

When selecting an AI arbitrage tool, several critical performance metrics warrant consideration:

Speed and Latency:

Trade execution velocity

API connection stability

Server location and latency optimization

Supported Exchanges and Trading Pairs:

Number of connected exchanges

Range of supported trading pairs

Liquidity depth analysis

AI Algorithm Adaptability:

Machine learning capabilities

Strategy optimization frequency

Historical performance data

Security and Risk Management:

Fund security measures

API permission restrictions

Risk control functionalities

The most effective AI arbitrage tools should demonstrate exceptional performance across these dimensions while providing transparent performance reporting and user feedback.

Case Studies: Successful Application of AI Tools in Cryptocurrency Arbitrage Trading

Cross-Exchange Arbitrage in Practice

A trader using Bitsgap shared his arbitrage experience with the BTC/USDT trading pair. During a period of market volatility, Bitsgap's AI system detected approximately a 0.8% price differential between Binance and Kraken. After accounting for transaction fees and transfer times, the system calculated a net profit of approximately 0.5% and automatically executed the arbitrage trade.

The entire process from detection to completion required less than three seconds, whereas manual execution would likely have taken several minutes, by which time the price differential would probably have disappeared. This trader reported that after implementing AI arbitrage tools, his monthly average returns increased from 1.2% to 2.8%.

AI Advantages in Triangular Arbitrage

Another success story comes from a trader utilizing Cryptohopper's AI triangular arbitrage functionality to arbitrage between ETH/BTC/USDT trading pairs. Cryptohopper's AI system can calculate price relationships between the three trading pairs in real-time, identifying imbalance points with remarkable precision.

During one particularly successful trade, the system discovered a profit opportunity of approximately 0.3% (after fees) through the ETH/BTC→BTC/USDT→USDT/ETH pathway. Since such triangular arbitrage opportunities typically exist for only seconds, human detection and execution would be virtually impossible, yet the AI system completed the entire process seamlessly. This trader reported that the AI triangular arbitrage feature generates additional daily returns of 0.5-1% on average.

AI Tool Experience for Small-Capital Traders

A beginner shared his experience using TradeSanta's AI arbitrage functionality. Starting with $1,000, he implemented the platform's "Beginner Arbitrage Strategy," which focuses on trading pairs with high liquidity and moderate volatility.

After three months of utilization, his account had grown by 12%, while friends trading manually during the same period achieved only 5% returns. He specifically mentioned how TradeSanta's AI risk management functionality helped him avoid several potentially unprofitable trades, as the system automatically skipped arbitrage opportunities that appeared lucrative but carried excessive risk.

Future Development Trends in AI Arbitrage Tools

Deep Learning Applications in Arbitrage Trading

Next-generation AI arbitrage tools are incorporating more sophisticated deep learning technologies, enabling them to:

Predict future arbitrage opportunities rather than merely reacting to current ones

Identify complex market patterns and cyclical arbitrage windows

Automatically adjust strategies to adapt to evolving market conditions

Learn from each transaction to optimize future decision-making

For example, Gimmer's next-generation AI system under development can analyze six months of historical market data to identify patterns where specific trading pairs are more likely to present arbitrage opportunities during particular time periods, and adjust its monitoring strategy accordingly. This predictive arbitrage approach may become a standard feature of future AI tools.

Cross-Chain Arbitrage and DeFi Integration

As decentralized finance (DeFi) continues to evolve, AI arbitrage tools are expanding into this domain:

Cross-chain arbitrage (between different blockchain networks)

DEX arbitrage (decentralized exchanges)

Liquidity pool arbitrage

Yield farming arbitrage strategies

Platforms like Bitsgap and Cryptohopper have begun testing DeFi arbitrage functionalities, which will enable traders to capitalize on price differentials between centralized and decentralized markets. This trend is expected to accelerate in the coming years, opening entirely new profit opportunities for AI arbitrage tools.

Regulatory Adaptation and Compliance AI

As the regulatory environment for cryptocurrencies continues to evolve, AI arbitrage tools are adapting to maintain compliance:

Automatic tax reporting functionalities

Regulation-friendly trading records

Region-restricted trading capabilities

Compliance risk assessment

For instance, TradeSanta's "Compliance AI Assistant" feature under development will help users ensure their arbitrage activities comply with local regulations and automatically generate required tax and compliance reports. Such functionality will make AI arbitrage tools more attractive to institutional investors.

Conclusion: AI Tools Are Reshaping Cryptocurrency Arbitrage Trading

AI tools are fundamentally transforming the cryptocurrency arbitrage trading landscape, democratizing a strategy that was once effectively executable only by professional traders. From speed and precision to risk management and strategy diversification, AI brings unprecedented advantages to arbitrage trading.

Whether you're a beginner or an experienced trader, modern AI arbitrage tools offer functionalities suited to your requirements. The key is selecting tools aligned with your trading style, experience level, and risk preferences, then investing time in learning how to effectively utilize their AI capabilities.

As AI technology continues to advance, we can anticipate arbitrage tools becoming increasingly intelligent, autonomous, and efficient. Traders who adopt and master these tools early will gain significant advantages in the increasingly competitive cryptocurrency market.

Finally, remember that even the most advanced AI tools cannot guarantee profits, as market risks always remain. The prudent approach is to begin with modest capital, gradually familiarize yourself with these tools, and incorporate them as components of a broader trading strategy rather than relying on them exclusively.