In the ever-evolving landscape of tech IPOs, few upcoming offerings have generated as much buzz in the writing and AI space as Grammarly. This AI-powered writing assistant has transformed from a simple grammar checker into an essential productivity tool used by millions worldwide. As Grammarly prepares to transition from a private company to a publicly traded entity, investors, market analysts, and tech enthusiasts are closely watching what could be one of the most significant tech IPOs of recent years.

But what exactly does Grammarly's IPO mean for potential investors? How might it reshape the broader market for AI-driven productivity tools? And what factors should you consider before deciding whether to invest in this writing technology pioneer? Let's dive into a comprehensive analysis of Grammarly's upcoming market debut and what it could mean for your investment portfolio.

Grammarly's Journey to IPO: Understanding the Company's Growth Trajectory

Before analyzing the potential impact of Grammarly's IPO, it's crucial to understand the company's remarkable growth story and how it positioned itself for this significant milestone.

How Grammarly Evolved from Grammar Checker to AI Writing Assistant

Grammarly began its journey in 2009 with a straightforward mission: help people communicate more effectively through automated grammar checking. Founded by Alex Shevchenko, Max Lytvyn, and Dmytro Lider, the company initially focused on helping students improve their writing. However, Grammarly's vision quickly expanded beyond academic applications.

"What's fascinating about Grammarly's evolution is how they've consistently expanded their technology's capabilities," explains Samantha Chen, a tech industry analyst at Morgan Stanley. "They've transformed from a basic spell-checker into a sophisticated AI writing assistant that understands context, tone, and audience-appropriate language. This expansion of functionality has been key to their growth."

The company's product evolution timeline illustrates this transformation:

2009: Launch of basic grammar and spell-checking tool

2013: Introduction of browser extension to check writing across the web

2015: Release of Grammarly for Microsoft Office

2017: Launch of Grammarly keyboard for mobile devices

2019: Introduction of tone detection features

2020: Expansion into business communications with Grammarly Business

2022: Launch of GrammarlyGO, an AI writing assistant powered by generative AI

2023: Introduction of advanced features for different writing contexts and purposes

This continuous innovation has allowed Grammarly to build a massive user base estimated at over 30 million daily active users, including both free and premium subscribers.

Grammarly's Pre-IPO Funding Rounds and Valuation Growth

Grammarly's funding history reveals a company that has attracted significant investor interest while maintaining a relatively conservative approach to raising capital:

2017: $110 million Series A led by General Catalyst

2019: $90 million Series B led by General Catalyst, valuing the company at over $1 billion

2021: $200 million Series C led by Baillie Gifford, with a reported valuation of $13 billion

"What stands out about Grammarly's funding approach is how they waited until 2017 – eight years after founding – to raise their first major round," notes Michael Rodriguez, venture capital analyst at Pitchbook. "This suggests they were generating substantial revenue and operating efficiently long before taking significant outside investment. That's relatively rare in today's startup ecosystem and speaks to their strong unit economics."

This disciplined approach to fundraising, combined with the company's reported strong revenue growth, has positioned Grammarly as an attractive IPO candidate in a market that has become increasingly skeptical of unprofitable tech companies.

Grammarly's Market Position and Competitive Landscape Before Going Public

To accurately assess Grammarly's potential as a public company, investors need to understand its current market position and the competitive landscape it navigates.

Grammarly's Current Market Share in the Writing Assistant Space

Grammarly has established itself as the dominant player in the AI writing assistant market, though exact market share figures are difficult to obtain since many competitors are private companies. However, several metrics highlight Grammarly's market leadership:

Over 30 million daily active users across free and paid tiers

More than 50,000 teams and businesses using Grammarly Business

Integration with over 500,000 applications and websites

Browser extension installations exceeding 10 million on Chrome alone

"Grammarly has achieved something remarkable in the productivity software space," explains Dr. Emily Watson, professor of digital marketing at NYU Stern. "They've created a product that appeals to both individual consumers and enterprise customers, with a freemium model that effectively converts users from free to paid tiers. This broad appeal across different user segments gives them significant advantages of scale."

The company's revenue model combines:

Freemium subscriptions: Basic features available for free, with premium features requiring paid subscriptions

Enterprise sales: Grammarly Business offers team-based features and administrative controls

Educational partnerships: Special pricing and features for academic institutions

This diversified approach has reportedly helped Grammarly achieve annual recurring revenue estimated at over $200 million, though as a private company, exact figures remain undisclosed.

How Grammarly Competes Against Microsoft, Google, and AI Startups

Grammarly operates in an increasingly competitive landscape that includes both tech giants and nimble AI startups:

Microsoft Editor: Integrated into Microsoft 365, offering grammar and style suggestions

Google's Smart Compose and Smart Reply: Built into Gmail and Google Docs

ProWritingAid: Popular with authors and long-form content creators

Quillbot: Focusing on paraphrasing and rewriting capabilities

Jasper, Copy.ai, and other AI writing tools: Generating complete content from prompts

"What's impressive about Grammarly's competitive position is how they've maintained leadership despite competition from tech giants with virtually unlimited resources," says Alex Thompson, technology reporter at The Information. "Microsoft and Google both offer writing assistance features built directly into their productivity suites, yet Grammarly continues to thrive because their specialized focus on writing quality allows them to deliver a superior experience."

Grammarly's competitive advantages include:

Platform neutrality: Works across Microsoft, Google, Apple, and other ecosystems

Specialized focus: Dedicated exclusively to improving writing, rather than being a side feature

Advanced AI capabilities: Years of data and machine learning development

Brand recognition: Strong association with writing improvement

However, the emergence of generative AI tools like ChatGPT has created new competitive dynamics that Grammarly must navigate as it enters public markets.

Potential Impact of Grammarly's IPO on Different Investor Categories

Grammarly's public market debut will likely affect different types of investors in various ways. Understanding these potential impacts can help you position your portfolio appropriately.

How Retail Investors Can Approach Grammarly's Public Offering

For individual investors considering participation in Grammarly's IPO, several factors warrant careful consideration:

Growth potential: Grammarly's expansion into generative AI with GrammarlyGO positions it in one of tech's hottest growth sectors.

Profitability status: Unlike many tech IPOs, Grammarly is reportedly profitable, which may reduce some of the volatility typically associated with newly public tech companies.

Valuation considerations: The company's last private valuation of $13 billion came during the 2021 tech boom. Public market valuations for software companies have generally compressed since then.

Lock-up periods: Typical IPO lock-up restrictions prevent insiders from selling shares for 180 days after the offering, which can create volatility when these periods expire.

"Retail investors should approach Grammarly's IPO with both enthusiasm and caution," advises Jennifer Martinez, personal finance author and investment strategist. "On one hand, it's a rare opportunity to invest in a leader in AI-powered productivity with a proven business model. On the other hand, tech IPOs often experience significant volatility in their first year of trading, so position sizing and time horizon are crucial considerations."

For those unable or unwilling to participate in the IPO itself, watching the stock's performance during its first few quarters as a public company may provide better entry points with more financial information available.

Institutional Investors' Perspective on Grammarly's Market Debut

For institutional investors like mutual funds, pension funds, and asset managers, Grammarly presents an interesting addition to the public market landscape:

AI exposure: Provides portfolio exposure to practical AI applications with proven market adoption

Software category representation: Offers investment opportunity in the productivity software category, which has relatively few pure-play public companies

Competitive moat assessment: Requires evaluation of Grammarly's ability to maintain its leadership against both tech giants and AI startups

Growth sustainability: Necessitates analysis of how Grammarly can continue expanding its user base and average revenue per user

"From an institutional perspective, Grammarly represents an interesting addition to the public markets because it's a category-defining company with strong brand recognition," explains Robert Williams, portfolio manager at a large asset management firm. "The key questions institutional investors are asking revolve around sustainable competitive advantage in an era where large language models are becoming more accessible and powerful. Can Grammarly maintain its lead when the underlying technology is evolving so rapidly?"

Institutional investors will likely compare Grammarly to other software-as-a-service (SaaS) companies with similar growth profiles and margin structures to determine appropriate valuation multiples.

Grammarly's Financial Metrics and What They Signal to Potential Investors

While Grammarly has not yet published its S-1 filing with detailed financial information, various reports and industry analyses provide insights into the company's financial health and what investors might expect.

Analyzing Grammarly's Revenue Growth and Profitability Indicators

According to industry reports and statements from company executives, Grammarly's financial profile includes several noteworthy characteristics:

Revenue growth: Estimated annual recurring revenue exceeding $200 million, with consistent year-over-year growth

Profitability: Unlike many tech companies going public, Grammarly is reportedly profitable, though exact margins remain undisclosed

Customer acquisition efficiency: The freemium model allows for relatively low customer acquisition costs compared to enterprise software companies

Retention metrics: High reported user retention rates, particularly for premium and business subscribers

"What makes Grammarly particularly interesting from a financial perspective is their apparent efficiency," notes David Chen, fintech analyst and former investment banker. "Many software companies go public while still burning significant cash, but Grammarly appears to have built a business that combines growth with profitability. This suggests disciplined management and strong unit economics, which typically translate well to public markets."

When the company files its S-1, investors should pay particular attention to:

Gross margin: Indicating the scalability of Grammarly's business model

Revenue breakdown: Between consumer and enterprise customers

Customer retention: Net revenue retention showing expansion within existing accounts

R&D investment: Particularly in AI capabilities to maintain competitive advantage

How Grammarly's Business Model Compares to Other Recent Tech IPOs

Grammarly's business characteristics set it apart from many recent tech IPOs in several important ways:

Profitability before IPO: Contrasts with companies like Uber, Lyft, and many SaaS businesses that went public while still generating losses

Balanced growth and efficiency: Appears to prioritize sustainable growth rather than growth at all costs

Direct consumer revenue: Successfully monetizes individual users, unlike many tech platforms dependent entirely on advertising or enterprise sales

Proven product-market fit: Demonstrated through years of user growth and retention

"When comparing Grammarly to recent tech IPOs, what stands out is their apparent patience and discipline," explains Sarah Johnson, IPO analyst at a major investment bank. "They've built the business over more than a decade, raised capital strategically rather than excessively, and reportedly achieved profitability before going public. This old-school approach to building a sustainable business before seeking public investment has become increasingly attractive to public market investors after some disappointing performances from high-profile, high-burn tech IPOs."

This profile may position Grammarly to receive a warmer reception from public markets than some recent tech offerings, particularly in an investment environment that has become more focused on near-term profitability and cash flow.

Market Trends That Could Influence Grammarly's Post-IPO Performance

Several broader market and technology trends will likely influence Grammarly's performance as a public company.

How AI Industry Developments Could Impact Grammarly's Stock

The rapidly evolving AI landscape presents both opportunities and challenges for Grammarly as it enters public markets:

Generative AI integration: Grammarly's expansion into generative AI with GrammarlyGO positions it within one of tech's hottest sectors, potentially attracting investors seeking AI exposure.

Commoditization risks: As large language models become more accessible, Grammarly must continue differentiating its offerings beyond basic writing assistance.

Enterprise AI adoption: Growing corporate investment in AI productivity tools could accelerate Grammarly Business adoption.

AI regulation: Emerging regulations around AI usage, particularly in sensitive contexts, could create both compliance challenges and opportunities for trusted providers like Grammarly.

"Grammarly sits at an interesting intersection in the AI landscape," observes Dr. Robert Chang, AI researcher and industry consultant. "They've built their technology and reputation during the pre-generative AI era but are now adapting to incorporate these new capabilities. Their challenge will be maintaining their specialized advantage in writing assistance while large language models become increasingly capable of general-purpose text generation and editing."

Investors should watch how Grammarly continues to innovate with AI while maintaining its focus on its core value proposition of improving written communication.

Grammarly's Potential Expansion into New Markets and Product Categories

Grammarly's future growth as a public company may depend on successful expansion beyond its current product offerings:

International markets: Expanding beyond English-language markets represents a significant growth opportunity.

Vertical-specific solutions: Developing specialized tools for industries like legal, healthcare, or financial services.

Educational technology: Deeper integration into educational institutions and learning management systems.

Enterprise communication: Expanding features for team collaboration and organizational communication.

"The writing assistance market is just the beginning for Grammarly," suggests Maria Rodriguez, technology industry strategist. "Their underlying technology for understanding and improving communication could be applied to numerous adjacent categories, from improving verbal communication to facilitating cross-language collaboration. Their challenge as a public company will be balancing focus on their core product with strategic expansion into new growth areas."

How effectively Grammarly communicates and executes on this expansion vision will likely influence investor sentiment and stock performance post-IPO.

Potential Risks and Challenges for Grammarly as a Public Company

While Grammarly has built an impressive business, several risks and challenges could affect its performance as a public company.

How Competition from Tech Giants Could Pressure Grammarly's Growth

Grammarly faces intensifying competition from several directions:

Microsoft's expanding capabilities: Microsoft Editor continues to improve and comes bundled with widely used Office products.

Google's writing features: Smart Compose, Smart Reply, and other AI writing features are integrated into Google's productivity suite.

Apple's system-level tools: Writing suggestions built directly into iOS and macOS.

OpenAI and other AI labs: Increasingly powerful generative models that can perform many writing assistance functions.

"The competitive landscape for Grammarly has become significantly more complex in the past two years," notes Thomas Wilson, software industry analyst. "When large tech companies with massive distribution advantages and virtually unlimited R&D budgets decide to compete in your space, maintaining differentiation becomes increasingly challenging. Grammarly will need to continuously innovate and leverage its specialized focus to stay ahead."

Public market investors tend to be particularly sensitive to competitive threats from tech giants, which could create volatility in Grammarly's stock price when competitors announce new features or initiatives.

Privacy Concerns and Regulatory Risks Facing Grammarly's Business Model

As an AI company that processes sensitive user content, Grammarly faces several regulatory and privacy-related challenges:

Data usage concerns: Questions about how user writing samples inform AI models.

Privacy regulations: Compliance with GDPR, CCPA, and other emerging privacy frameworks.

Industry-specific regulations: Special requirements for sectors like healthcare, education, and finance.

AI transparency requirements: Emerging regulations requiring explainability of AI-driven recommendations.

"AI companies that process user-generated content face increasing scrutiny from regulators and privacy advocates," explains Lisa Thompson, technology policy researcher. "Grammarly has generally maintained a strong privacy posture, but as a public company, they'll face even greater pressure for transparency about data usage, model training practices, and user privacy protections."

These concerns could potentially limit Grammarly's ability to leverage user data for product improvements or create additional compliance costs that impact margins.

Investment Strategies for Approaching Grammarly's Public Market Debut

For investors interested in participating in Grammarly's public market journey, several strategic approaches warrant consideration.

Long-term Investment Case for Grammarly's Stock

For those considering Grammarly as a long-term holding, several factors support the investment thesis:

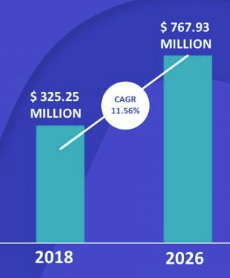

Expanding market opportunity: The global market for AI-powered productivity tools continues to grow as organizations seek efficiency improvements.

Strong brand recognition: Grammarly has achieved rare name recognition in the productivity software space.

Recurring revenue model: Subscription-based approach provides predictable revenue streams.

Cross-platform advantage: Platform-agnostic approach allows Grammarly to serve users regardless of their primary technology ecosystem.

"The long-term case for Grammarly rests on their ability to maintain their position as the leading writing assistant while expanding into adjacent productivity categories," suggests William Chen, technology fund manager. "If they execute well, they could become the central platform for AI-enhanced communication across text, voice, and potentially even video contexts."

Long-term investors should be prepared for potential volatility in the stock's first year of trading while focusing on key metrics like revenue growth, customer retention, and successful new product introductions.

Short-term Trading Considerations Around Grammarly's IPO

For investors with shorter time horizons, Grammarly's IPO presents different considerations:

IPO pricing relative to private valuation: Whether the offering prices above, at, or below the last private valuation of $13 billion will influence initial trading dynamics.

Lock-up expiration planning: Typical 180-day insider selling restrictions create predictable periods of potential increased supply.

Earnings report catalysts: The first several quarterly reports will provide crucial information about growth trajectory and public market execution.

Analyst coverage initiation: The perspectives of Wall Street analysts will influence institutional sentiment after the quiet period ends.

"IPOs often follow predictable patterns that short-term traders can incorporate into their strategies," explains James Rodriguez, IPO trading specialist. "There's frequently a pop on the first day of trading, followed by a settling period, then increased volatility around lock-up expirations and early earnings reports. Understanding these patterns can help traders position accordingly."

Short-term traders should pay particular attention to the initial pricing range when announced and how it compares to the final IPO price, as this can provide insights into institutional demand.

Conclusion: What Grammarly's Public Debut Signals for the Tech IPO Market

Grammarly's transition from private to public company represents more than just another tech IPO. It signals several important trends in the technology investment landscape.

First, it highlights the growing investor interest in practical AI applications with proven business models, rather than purely speculative AI technologies. Grammarly has demonstrated the ability to monetize AI-powered writing assistance at scale, providing a template for how AI can enhance knowledge worker productivity.

Second, it potentially marks a return to more fundamentally sound tech IPOs after a period of highly unprofitable companies going public. Grammarly's reported profitability and disciplined growth approach may indicate shifting investor preferences toward sustainable business models.

Finally, it underscores the enduring value of focused execution in specific verticals, even as tech giants expand their reach. Grammarly's success despite competition from Microsoft, Google, and others demonstrates that specialized tools can thrive alongside platform offerings when they deliver superior experiences in their domain.

For investors, Grammarly's IPO offers an opportunity to gain exposure to the intersection of AI, productivity software, and communication tools – three domains with significant long-term growth potential. Whether as a short-term trading opportunity or long-term investment, Grammarly's public market journey will be worth watching closely as it navigates the challenges and opportunities of life as a public company.

See More Content about AI tools